Last Updated on 2 years ago by Anoob P T

In this post, we are going to look at What is Salary Slip, Importance, Components, Eligibility, Deductions & A Sample Salary Slip.

Getting your first salary slip is a great feeling.

I remember getting my first salary slip for INR 5500.

This is a picture of my bank statement with my first salary.

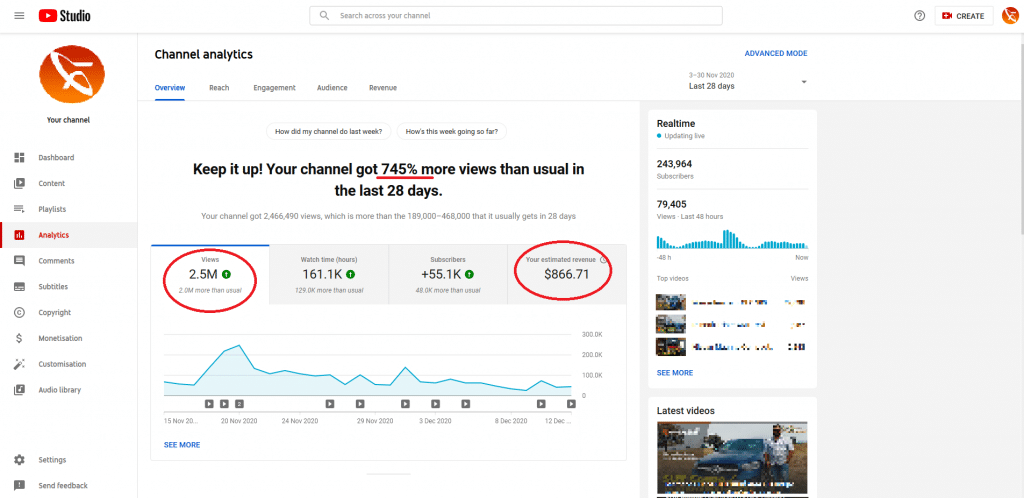

After starting with this salary, my last full time salary was over INR 35 Lakhs per annum and I was making around $6000 on side through my side gig.

If you are interested in the whole concept of making money online, you can check out some of my other posts including 10 Easy Ways to Earn Money Online without Investment, How to Earn Money from YouTube, how to earn money from Facebook and how to start a blog and make money.

I recently helped a client of mine generate $1000 in income from his YouTube channel that was not making any money and even you can do the same.

Earlier, I had co-founded a video company and raised $2 million in funding and then got fired from the company I started. I had done lot of testing and research on how to monetize YouTube and now I use the same skills to help other YouTubers.

You can read my full story here if you are interested.

I have also written a detailed post about How to Start an Online Business That Changes Your Life (without Luck) & lessons in entreprenuership I learnt the hard way–you can read it if you have the time.

Even though the money was not much, my salary slip had proof that I was employed and had an income coming into my bank account every month.

Like all other employment documents salary slip is very important and there are many things to a salary slip than it being proof of salary.

Salary Slip Format, Components, Deductions & Sample

In this article, I will explain the salary slip format, importance of salary slip, various components of salary slip, salary slip eligibility, deduction in salary slip, a sample salary slip etc.

I’m sure you have lot of questions on different components of salary slip, you can skip to that section directly if you want.

Table of Contents

What is Salary Slip?

A salary slip or a pay slip is a document issued by your employer which consists of a detailed description of employee’s salary components like HRA, LTA, Bonus paid etc.

Your salary slip will also include information about deductions for a specified time period, usually a month.

It is produced in the form of a printed hard copy given to the employee or an electronic soft copy mailed in a PDF format.

There are different formats for different pay slips depending upon the company. Employers are legally bound to issue a salary slip to every employee so as to give them an idea about their basic salary, allowances and tax deduction.

Moreover, your salary slip is the document which acts as a legal proof of your employment.

Importance of Salary Slip

Your salary slip is the legal proof of your employment, earning and deductions. While applying for visa or to executive programs at various universities, you may have to submit copies of your pay slip, as a proof of your last drawn salary and designation.

The income tax amount which you need to pay totally depends on the salary slip and the income tax return amount, which you claim from the government. Hence, it is your right to ask your employer for a salary slip.

Your salary slip acts as an important document when it comes to Income Tax planning. Your salary contains different components like Basic Salary, HRA, DA, other allowances like medical or travel and all of these have different tax treatments.

An account of these components helps you to calculate your income tax savings and to maximise the same. The salary slip gives employees access to various free or subsidised facilities provided by the government such as medical care, subsidised food grains, etc.

You may look for a loan or may borrow money in times of necessity. Your salary slip acts as an important document while applying for credit card, loan, mortgage and other borrowings. It is a proof of your monthly income to determine your repayment potential, the amount to be availed as well as an assurance of money being repaid.

While seeking for a new employment, you can negotiate about the salary by checking with your previous pay slip. With the help of this, you can choose based on an economical benefit wisely. In addition, your salary slip helps you to calculate the retirement savings through the PF amount deducted.

To sum up, importance of salary slip are

- Calculation of Income Tax

- Procuring Loans

- Proof of Employment

- For Future Employment Opportunities

- Access to select government incentives

Who is Eligible for a Salary Slip?

Every salaried employee is eligible for a salary slip. It is in fact the legal right of every employee to ask his /her employer to provide a salary slip. It could either be a printed hard copy or an electronic soft copy in the PDF format.

Usually, the latter way is preferred so that the employee can download it at any time and there will not be any chances of it getting lost, unlike the printed copy. In cases where they are not able to provide a salary slip regularly, you can ask for Salary Certificate.

Major Components of Salary Slip

The major components categorised as incomes or earning in a salary slip are Basic Salary, Dearness Allowance, House Rent Allowance, Conveyance Allowance, Leave Travel Allowance, Medical Allowance, Performance Bonus and Special Allowance.

The Basic Salary constitutes nearly 35-40% of your gross total salary. Your basic salary decides various other components of the salary slip. A percentage of your basic salary is allotted for other allowances.

The higher your basic salary, the higher will be allowances as well as deductions. Your income tax amount is also decided by the basic salary.

Dearness allowance (DA) is paid to reduce the impact of inflation on the employee. It is associated with the increasing cost of living and hence, is depended on the location of the employee. DA is taxable.

House Rent Allowance (HRA) is nearly 40-50% of your basic salary, paid in order to help you with the house rent. It is exempted from tax for employees who pay house rent. The amount depends on the locality of your house, i.e., in metro cities you will get 50% of the basic salary as allowance.

Conveyance allowance is an allowance to cover cost of travel from home to work and from work to home. It is also exempted from Income Tax payment up to a certain limit depending upon the money you spend.

Leave Travel allowance is an allowance to cover the cost of your travel or that of your immediate family members while on leave. You can claim this allowance with the proof of your travel. . Whether you can travel alone or with your family, an exemption for up to two journeys in a block of four calendar years can be claimed.

Medical Allowance covers the medical expenses of an employee while in employment and can be claimed with the proof of expenses. It is exempted from tax for up to Rs.15000.

Performance Bonus and Special Allowances are given as a reward to the employee who exhibits an extraordinary performance. It is given generally as a mode of encouragement and is taxable.

There may be various other allowances paid by employers to employees for different purposes. Employers may choose to categorise these allowances in a separate head, or club them together under ‘Other Allowances’.

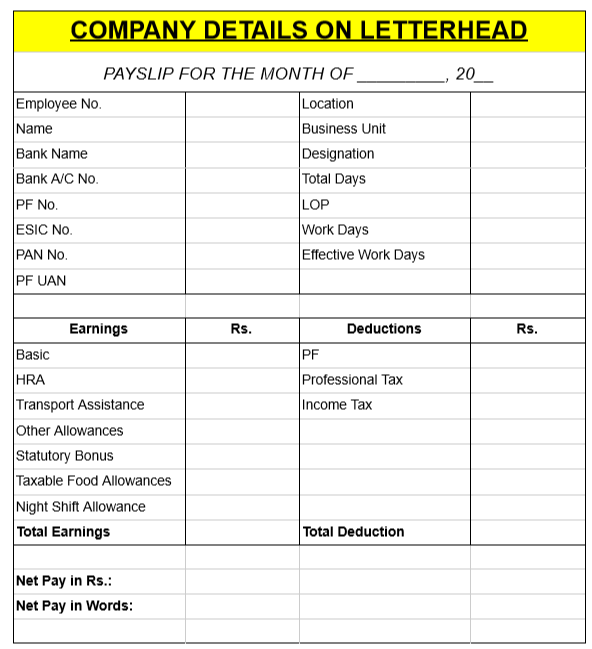

Salary Slip Format

Salary slip format is something that differs from company to company. However, most of the components of a salary slip remains the same with few minor changes.

Major Deductions in Salary Slip

Provident Fund (PF) is a major and compulsory deduction which amounts to 12% of your basic salary. This amount is saved for your retirement and pension funds. This fund is exempted from your tax amounts.

Professional Tax is levied from any person who is employed and is a small amount, usually Rs.200. This is under the governance of state governments and is not applicable to every state in India. The amount also differs in different states.

Tax Deductible at Source (TDS) is deducted by the employer on behalf of the Income Tax Department. You can reduce TDS by investing in tax-saving schemes and submitting the appropriate documents to your employer.

What is exemption u/s 10 in salary slip

Section 10 under Income Tax Act coveres allowances such as house rent, leave travel allowance, research/academic allowance and uniform allowance.

Under special allowance act of Section 10 (14), exemption is permitted depending on specific amount utilised for a specific purposes.

Your excemption will depend on

Allowance amount.

Actual amount used for the purpose for which the allowance has been granted.

What is ytd in salary slip

YTD or Year-to-date is the amount of money spent on payroll from the beginning of the year (calendar or fiscal) to the current payroll date.

Year to date column in your payslip shows total Gross Salary, total deductions, total tax deducted and net income based on the particular calendar year.

What is hra in salary slip

HRA or House Rent Allowance is the amount of money given by the employer to pay rent. This component provides employees with tax benefits for the amount given as rent. There are some requirements to claim this amount. Please check with your HR/ Payroll company for your company’s specific requirements.

What is lta in salary slip

LTA or Leave Travel Allowance is the allowance permitted under your CTC for travel costs which can be exempted from income tax. Your LTA allowance depends on your CTC and there are some rules for claiming this, please check with your HR/ payroll company for exact details.

What is lwf in salary slip

LWF or Labor Welfare Fund is a fund administered by Ministry of Labor with an aim to provide social security to unorganized labors. This deduction is made from employees as well as employers side.

What is special allowance in salary slip

Special allowance is an amount that is provided to employees over the basic salary which is usually provided to meet some requirements. Special allowance in payslip will be indicated separately and some component of it is taxable and some are exempt from taxes.

What is lop in salary slip

LOP means Loss of Pay. It is also called Leave without Pay or LWP. LOP on your salary slip means you have lost pay for those number of days for which you were absent from work.

Usually LOP is applied when your paid/earned leaves have been exhausted and you were still absent from work.

LOP on payslip will be indicated as number of days and daily salary is deducted based on the number of days you were absent from work.

What is professional tax (pt) in salary slip

Professional tax is something anyone who is earning an income from salary or performing a practiced profession (Doctors, lawyers, accountant etc.) has to pay to the government.

When I received my first pay slip I saw that there was a deduction of Rs.200 in it and I though why are they charging me tax when my income was not even taxable.

Then I consulted my sister who is a Charted Accountant and she told me that professional tax is something mandatory and that it will be deducted.

Different states have different slabs of professional tax. It can range between Rs.200 to Rs.2,500 depending on the state where you are employed.

What is gratuity in salary slip

Gratuity is that part of salary which is paid by an employer as a gratitude for the services provided by the employee during the tenure in the company. In most companies you would find that gratuity plans are defined along with other retirement benefits when the employee is leaving the organization.

The amount of gratuity is covered under the cost to company (CTC) which is also reflected in the salary slip. As per law, since gratuity is part of compensation, it is taxable.

Gratuity is that part of salary which is paid by an employer as a gratitude for the services provided by the employee during the tenure in the company. In most companies you would find that gratuity plans are defined along with other retirement benefits when the employee is leaving the organization.

The amount of gratuity is covered under the cost to company (CTC) which is also reflected in the salary slip. As per law, since gratuity is part of compensation, it is taxable.

Your gratuity is a gratuitous gift from the employer to the employee. It is usually provided when the employee completes around 5 years of continuous service in the company. Every year the organization creates a provision for the payment of this gratuity amount.

In the past, employees used to stick to a company for many years and hence gratuity was attractive. Now a days, duration of employment with a company has drastically come down and people no longer view gratuity with the same value as before.

Note: Difference between Gratuity & Provident Fund (PF)

Provident fund is a lump sum to which employer and employee is contributing regularly and employee can access this fund at the time of retirement or under special circumstances. Gratuity amount is completely separate from this.

What to do in case you lose Salary Slip?

If you lose your pay slip, you can contact the HR of Finance Department to get another copy or a duplicate payslip. When applying for a new job also, you can ask for pay slip to your previous employer. A salary certificate can also be considered equivalent to the salary slip, which will be provided by the employer.

If you have lost your salary slip and need to show proof of income to your new employer you can consider showing bank statement or even Form 16.

Recommended Reads

Side Hustles to Help You Make Money Online

How to Earn Money from YouTube [Step By Step Guide]

10 Easy Ways to Earn Money Online

How to Earn Money from Facebook [Step By Step Guide]

Best Work from Home Jobs to Earn Money Online

12 Best Paying Entry Level Work from Home Jobs That Require No Special Qualifications

How to Start Blogging and Make Money

Salary Slip Format, Components, Deductions & Sample

Salary Slip Summary

A salary slip is one of the most important documents you will need to prove your employment history. We hope you understoood what is Salary Slip, Importance, Components, Eligibility, Deductions & A Sample Salary Slip. You should keep a copy of your salary slip always safe and once you leave an organization, it becomes almost impossible to collect the salary slip again.

Overall

5-

Salary Slip

Pros

Most companies now use electronic salary slip

Salary slip does not require physical signature

Many companies consider salary slip instead of experience letter

Cons

Once you move out of the organization, it is hard to get the salary slip

Some components of salary slip can sound confusing.