Last Updated on 2 years ago by Anoob P T

Are you wondering whether you should consider Motive Financial? In this post, we are going to look at Motive Financial Review, types of accounts, fees, how to open an account & Motive Financial rates.

Table of Contents

What is Motive Financial?

Motive Financial is an online bank in Canada that offers a variety of different banking accounts for various purposes.

This post is part of our series where we review some of the best financial products, services and businesses in Canada. You can check out some of our other related posts including if it interests you.

Best Chequing Account in Canada

How to Make Money Online in Canada

Instant Approval Credit Cards for Bad Credit in Canada

Over the past few years, online-only banks are growing in Canada because of their lower operational costs and allowing users to transact at a lower fee.

Motive Financial is part of Canadian Western Bank and hence, when you deposit money in Motive Financial, deposits are held at Canadian Western Bank which is a member of Canada Deposit Insurance Corporation (CDIC) so your money will be safe.

Types of Account offered by Motive Financial

Motive Financial Savings Account

Motive Financial offers two types of savings accounts: Motive Savvy Savings Account and the general Motive Savings Account.

Motive Savvy Savings Account

The Motive Savvy Savings Account is ideal for anyone who wants a savings account to save money.

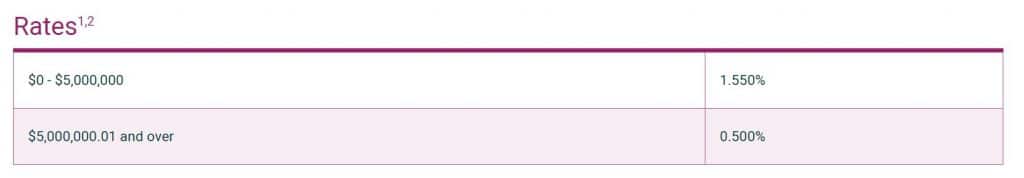

Motive Savvy Savings Account offers 1.550% interest rate and a host of other features.

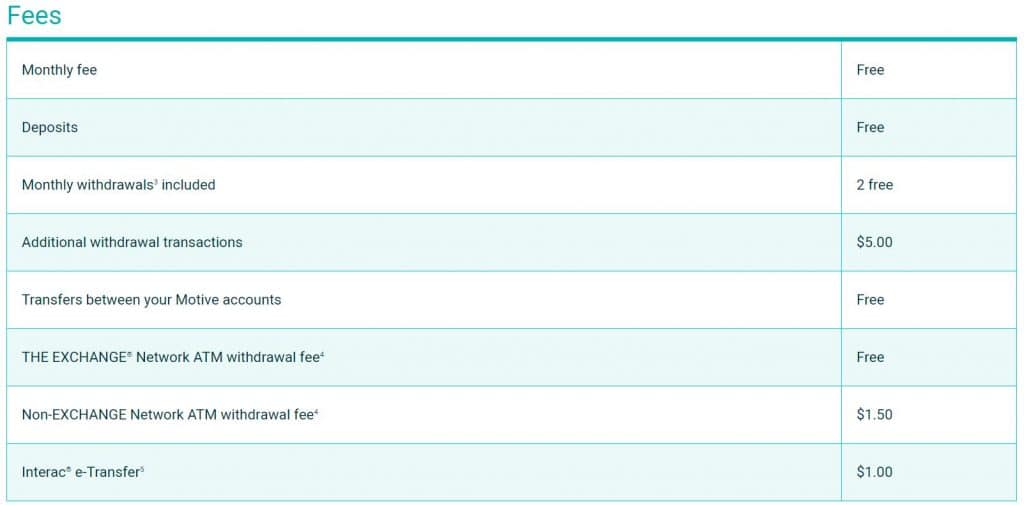

- No minimum balance

- No monthly fee

- Free deposits and unlimited transfers between accounts

- 2 free transactions per month

Motive Savvy Savings Account Rates

Motive Savvy Savings Account Fees

Official Link for Motive Savvy Savings Account

Motive Savings Account

Motive Savings account is ideal for customers who are used to saving money and using other savings accounts.

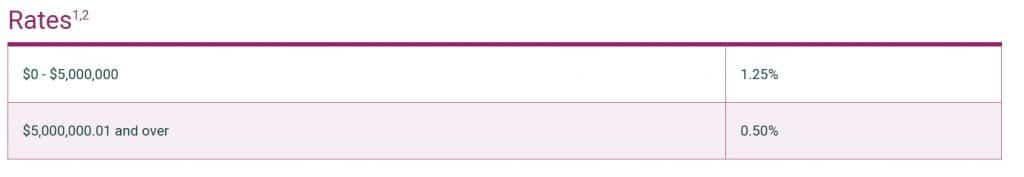

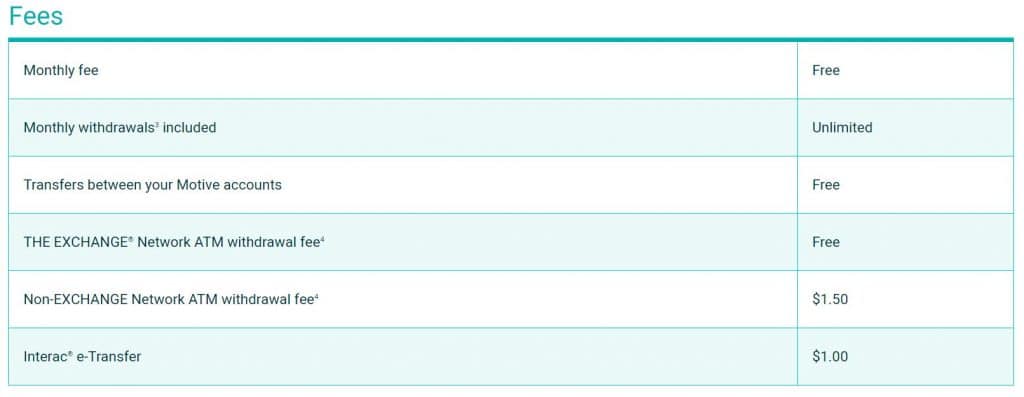

Motive Savings account does not require any minimum balance and no monthly fee. With a Motive savings account, you can also enjoy free deposits and withdrawals, competitive interest rates and access to the second largest ATM network in Canada.

Motive Savings Account Rates

Motive Savings Account Fees

Motive Financial Chequing accounts

Motive financial offers two types of chequing accounts, Motive Cha-Ching Chequing Account and Motive Chequing Account.

Motive Cha-Ching Chequing Account

The highlight of Motive Cha-Ching Chequing Account is unlimited free transactions and Interac e-Transfers and Motive Cha-Ching Chequing Account also offers a host of other features too.

Some of the features of Motive Cha-Ching Chequing Account are:

- Free Interac e-Transfers

- Unlimited free transactions and no monthly fee

- Second largest ATM network in Canada

- 50 personalized cheques included

- 0.25% interest on account balance

- Access to THE EXCHANGE Network of ATMs, 2,400+ ATMs across Canada

- 2 free withdrawals from non-network ATMs

- Up to 5 external bank accounts linking

Motive Cha-Ching Chequing Account Rates

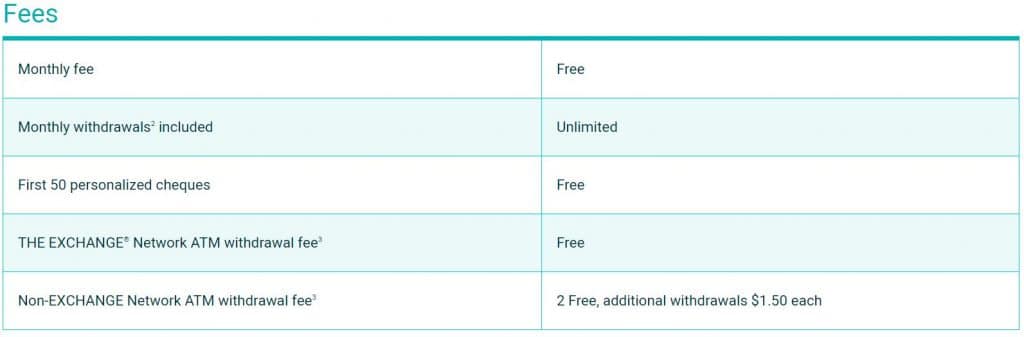

Motive Cha-Ching Chequing Account Fees

Motive Financial GICs (Guarenteed Investment Certificates)

Like other financial institutions, Motive Financial provides Guaranteed Investment Certificates (GICs).

Current Motive Financial GICs (Guarenteed Investment Certificates) rates are

- 1 year: 1.400%

- 2 years: 1.600%

- 3 years: 1.65%

- 4 years: 1.7%

- 5 years: 1.800%

- 6 years: 1.900%

- 7 years: 2.00%

- 8- 10 years: 2.050%

Motive Financial RRSP & TFSA Account

Motive Financial does offer RRSP & TFSA Accounts for customers.

Motive Financial TFSA account has no minimum balance requirement and interest rate is 1.55%.

Motive RRSP account interest rate is 0.25% up to $2,500.

Motive RRSP account interest rate for accounts over $2,500 is 1.25%.

Motive Financial Rates vs Other Banks Comparison

- Motive Financial: 1.55%

- Oaken Financial: 1.25%

- Tangerine Bank: 2.15% (5 months)

- EQ Bank: 1.50%

- Hubert Financial: 1.30%

- People’s Trust: 1.50%

Motive Financial Login

If you already have an account with Motive Financial, you can use the official link below to login to your account.

How to Open an Account with Motive Financial

Motive Financial is an online-only bank so you can easily open an account with Motive financial by filling some essential details.

The account opening can be done in about 5 minutes and these are the details you will need to submit.

- Personal Details

- Social Insurance Number and driver’s licence

Official Link to Open Motive Financial Bank Account

Motive Financial App

Like all leading banks, Motive Financial also has an app that can be used by all customers for various banking transactions.

Motive Financial Android App Link

Motive Financial Apple App Link

The official Motive Financial app lets you

- View account balance

- View account activity

- Pay bills

- Initiate transfers

- Check latest interest rates

- Find ATMs nearby

- Use financial calculators such as TFSA calculator, FOREX calculator etc.

Motive Financial Customer Care

Motive financial is an online bank, so you cannot visit any branch for any banking services.

Motive Financial representatives are available on

Call: 1-877-441-2249

Email: info@MotiveFinancial.com

Fax: 1-877-441-2250

This is the Motive Financial general line that is reached Monday to Friday, 7:00 a.m. to 4:45 p.m. MT.

For 24-hour support, you can call 1-866-673-3918 and this number can be used to report lost or stolen debit cards and other emergencies or if you need online banking technical support.

Motive Financial Reviews

Motive Financial has generally good reviews on the web. In this section, we will feature one positive and one negative review of Motive Financial so that you get a general idea about the services of Motive Financial.

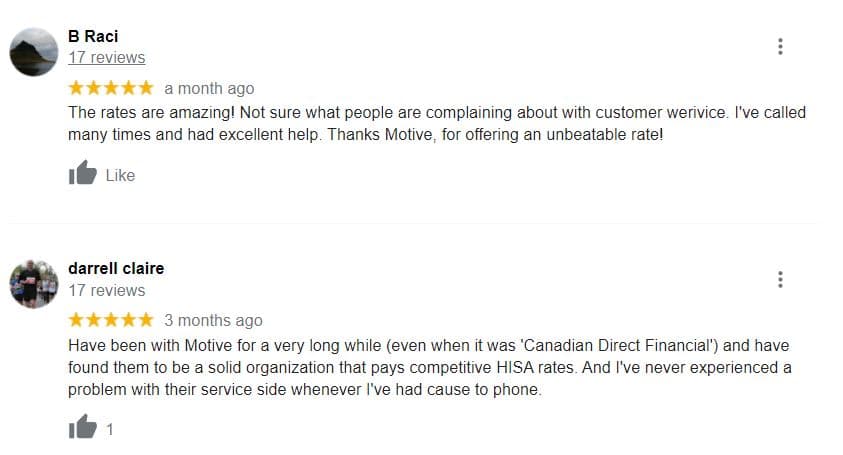

Motive Financial Positive Review

This is a positive review we found of Motive Financial on the web. Customers who leave a positive review about Motive Financial seems to be satisfied with the interest rate and general customer service.

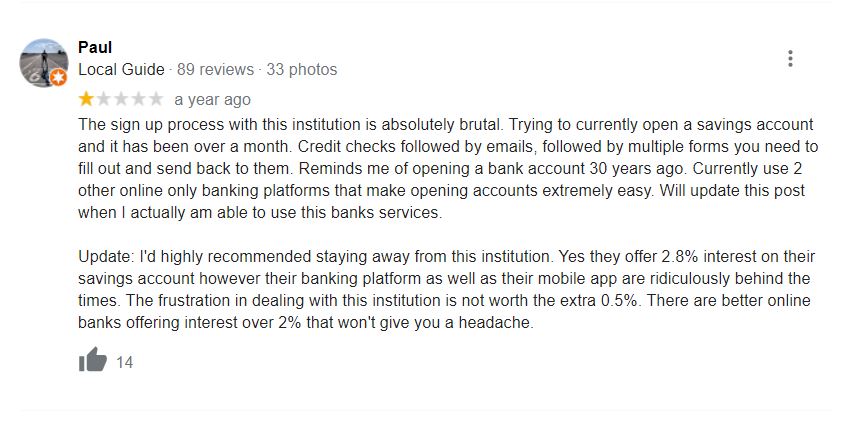

Motive Financial Negative Review

This is a negative review we found of Motive Financial. The review talks about difficulty in sign up process and the user seems to have some frustration about the onboarding process and issues with the usability of Motive Financial app.

Motive Financial Review Reddit

There is a Reddit thread that has some reviews and information about general onboarding process of Motive Financial, you can read check out the Reddit thread here.

Frequently Asked Questions About Motive Financial

Is Motive financial legit?

Yes, Motive Financial is 100% legit and is part of member of Canada Deposit Insurance Corporation (CDIC).

Is Motive financial CDIC insured?

Yes, Motive Finanical is CDIC insured.

Is Motive Financial Safe?

Yes, it is. When you deposit money in Motive Financial, deposits are held at Canadian Western Bank which is a member of Canada Deposit Insurance Corporation (CDIC) so your money will be safe.

Who owns motive Financial?

Canadian Western Bank

Recommended Reads