Last Updated on 2 years ago by Anoob P T

In this post, we are going to look at Lending Loop Review including Pros, Cons & Fees & Benefits of Lending Loop.

| Lending Loop | |

| What is It? | Lending Loop is a peer to peer (P2P) lending platform based out of Toronto, Canada. |

| Established Year | 2014 |

| Available Countries | Canada |

| Fees | 6.5% of Loan Value to the borrower and 1.5% to Lender |

| Main Features | Easy disbursement of loans, Online Account Opening |

| Phone Number | 888-223-5667 |

| Email Address | contact@lendingloop.ca |

| Are Complaints Reported | Some borrowers have complained of loans not being disbursed on time and some investors have complained of not able to get back initial investment |

| Is Lending Loop Legit | Yes, Lending Loop is a Legit company in operation from 2014 and has disbursed more than $80 Million CAD in loans to small businesses in Canada |

Lending Loop is a peer to peer (P2P) lending platform based out of Toronto, Canada. Lending Loop is one of the first P2P lending platforms in Canada that gives loans to small businesses.

Lending Loop provides loans for duration of 3 to 60 months and interest rate ranges between 5.9 to 15.5%.

While P2P lending looks like a good investment opportunity to earn some money, there are many risks associated with it. If you have surplus capital and you can take the risk–you can consider investing in a platform like Lending Loop.

I have two friends who have invested in P2P lending companies and one of them is getting good interest from the last 12 months and the other is not getting his capital back.

Therefore, whether P2P lending is worth it will depend of many factors including some bit of luck.

Lending Loop Review: Pros, Cons & Fees & Benefits

Table of Contents

What is Peer-To-Peer Lending?

Peer-to-Peer lending is an alternative to traditional banking. There are platforms where borrowers and lenders interact with one another like Lending Club or Lending Loop that allow borrowers to request loans for various needs.

The lenders see these loan requests and are able to choose who they want to give their money to.

Furthermore the platform gives them all sorts of information about the borrowers so that lenders can make educated decisions.

Some might settle for lower returns and only lend to the safest borrowers whereas others reach for yield but accept a higher degree of risk.

What is Lending Loop

Lending loop is a peer to peer (P2P) lending platform based out of Toronto, Canada.

Lending Loop is a great option to earn passive income through peer-to-peer lending.

There are different companies available in Canada for peer-to-peer lending but Lending loop is one of the earliest and most reputed platform for peer-to-peer lending.

Lending Loop is a Canadian company based off Toronto, Ontario. It is a fully regulated company and they have been in business since 2014.

According to Lending Loop website, as of December 2021, they have lent more than $80 Million CAD.

Official website of Lending Loop: https://www.lendingloop.ca/

How Does Lending Loop Work?

Lending Loop works similar to any other financial institution that offers loans to businesses but their screen process is not as strict as a bank.

Lending Loop screens loan applications and assign a loan grade to worthy borrowers.

Lenders can then purchase securities (in the form of notes) that correspond to fractions of these loans.

Lenders can purchase these notes from different borrowers for the portfolio of lenders is also diversified.

When loans are repaid, the credit is made to Lending Loop account which can be withdrawn or used for lending out again.

To know more about how Lending Loop works, you can visit this official link

Lending Loop Login

Lending Loop has a fairly simple Login page which can be accessed from desktop and mobile.

Lending Loop login page does not allow social logins through Gmail or Facebook so you need to have an account created with email address and login with your password.

This is the official Lending Loop Login Page

Lending Loop Borrowers

Lending Loop has a provision for small businesses to lend funds. The businesses can borrow from $ 100,000 to $500,000 as a loan based on their requirements.

Lending Loop Loan Requirements

There are some requirements to be eligible to lend from Lending Loop platform.

Some of the requirements to be using Lending Loop loans include:

- The business has to have been operational for at least one year.

- The annual revenue must be $100,000

- The personal credit score of the owner of the business must be above 600 points

To check if you are eligible for Lending Loop loans, you can visit this official Lending Loop Eligibility check page.

Lending Loop Investors

If you want to invest into any business using Lending Loop you have to sign up and open an account.

There are two ways to lend the money: first is you can lend the money manually. You can select the businesses of your choice and lend them money.

For that you are required to fill a questionnaire that helps determine your investment preference, financial strength and risk tolerance.

Your net worth plays an important role here as that leads to your classification as a non-eligible investor, eligible investor and accredited investor.

There is no specific criteria for a non-eligible investor, anyone can qualify for it. As a non-eligible investor you can invest up to $10,000 in a year.

You have to have an annual net income that exceeds $75,000 to classify as an eligible investor.

After which you can invest up to $100,000 every year.

As an Accredited Investor you can invest more than $100,000 per year.

It should be noted that you cannot start lending unless you deposit a minimum of $200 on the platform.

After this process, you can start browsing through the various applicants who are looking for a loan.

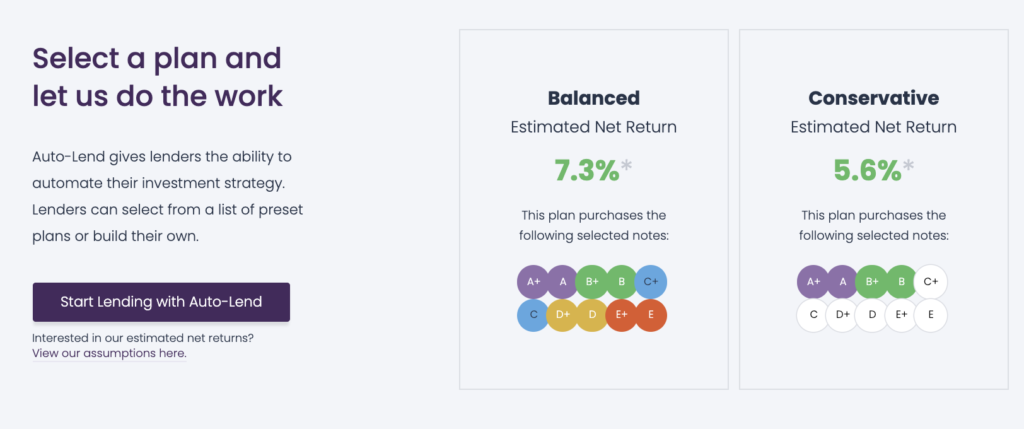

The second option is to go for Auto lending. In that case too you will have to fill a questionnaire determining your preferences.

Your profile will then be classified into a Balanced, Conservative, Aggressive and Custom Portfolio based on your answers.

If it’s a balanced portfolio you can earn up to 7.9% interest per year whereas if it’s a conservative portfolio you will earn around 6.7% per year in interest.

If you have a balanced portfolio then your money will be invested on the business based on their ratings from all ranges.

For businesses with the safest ratings the interest that you receive on your money will be the lowest. And businesses that have high risk ratings will fetch you the highest interest rate.

You may also stand a chance of being defaulted. But Lending Loop does screen the businesses well before the lending process so the chances of a default are slim.

In a conservative portfolio the high risk businesses will be avoided and loans with ratings ranging from A+ to B will be selected.

The aggressive plan as the name suggests is based on a high risk-high reward principle. It selects loans that are rated from the C+ to E category and have some of the highest risks.

The custom plan on the other hand gives you free reign and lets you decide on your investment according to your comfort and preference.

Lending Loop Returns

Lending Loop returns will depend on many factors and the platform has a Balanced and Conservative plan that will give you returns.

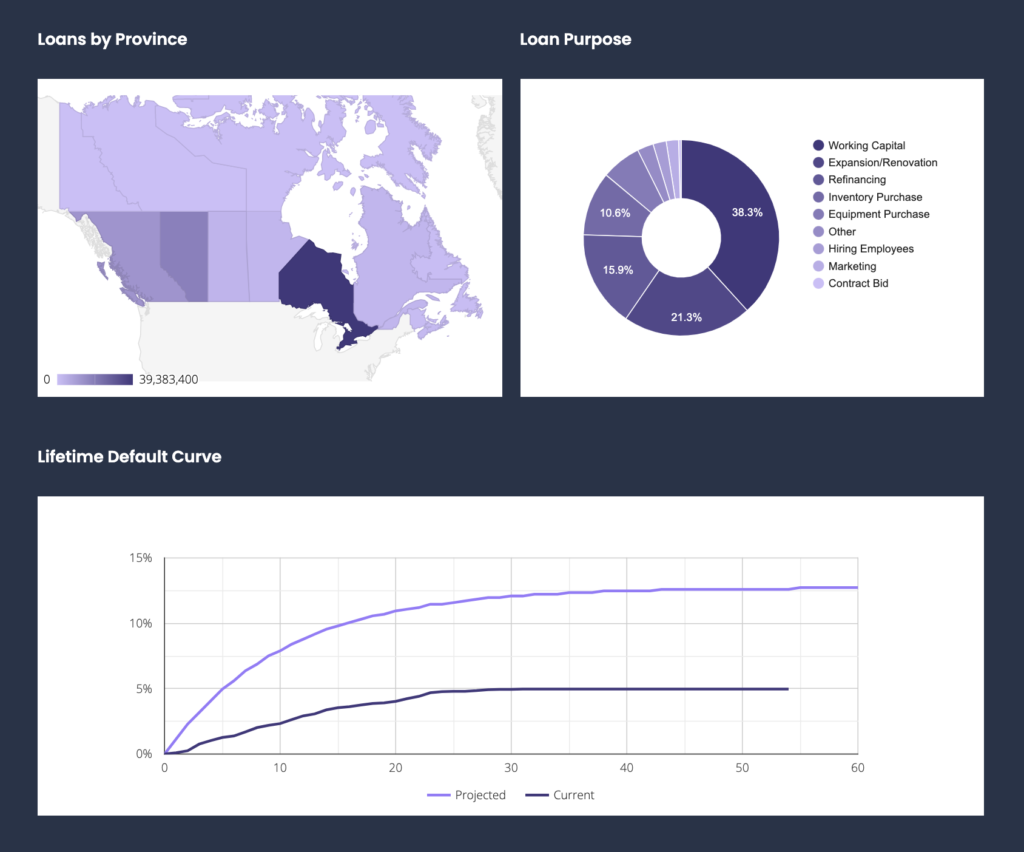

Lending Loop Statistics

According to Lending Loop website, the platform is very transparent in terms of statistics related to the Lending Loop platform.

Lending Loop Statistics page displays the kinds of businesses that are borrowing money, their location and industry sector.

Some of the highlights of Lending Loop Statistics include:

These are some Lending Loop Statistics you might find useful

To know more about Lending Loop Statistics, you can visit this official page.

Lending Loop Fees

You are not required to pay any fee to sign up, it is absolutely free.

But here are the fees that may apply to those who want to borrow from the site.

1. Borrowers will be required to pay an interest rate that can range from 5.90% to 26.50% depending on their lending loop in-house credit rating.

2. Apart from the interest rate borrowers also have to pay origination fees that can range from 3.0% to 6.5% which is also based on the in-house credit rating.

Lending Loop Fees for Lenders

Lenders on Lending Loop will also have to pay some fees for using the platform.

1. Lenders have to pay a servicing or management fee of 1.50% every year which is charged based on repayments.

2. Lenders might also have to pay a collection fee on the amount recovered after a loan is defaulted and Lending Loop takes it to collections.

Lending Loop Pros

There are some pros to using Lending Loop which you should know before using the platform.

- Lending Loop is fairly easy to navigate and setting up your profile is also hassle free

- The platform also makes your investing decisions easier for you through the auto lend platform.

- You get a chance to invest into small businesses and give them a boost.

- Lending Loop gives you an unparalleled opportunity of earning money through some of the highest interest rates.

- It is a legitimate and fully regulated money lending platform, all the transactions are transparent.

- It works as a platform that helps you diversify your investment portfolio

- You can refer the platform to your family and friends and both the parties will get $25 if your referrals invest at least $1,500

- In case of any disputes you are eligible for the resolution of the same via the trusted Ombudsman for Banking Services and Investments.

Lending Loop Cons

There are also some cons of Lending Loop which you should know before using the platform.

- If borrowers are unable to keep making payments and default, lenders lose money and aren’t covered by the positive guarantee schemes such as the FDIC in the United States

- Your money will be locked in for as long as it takes for loan repayment.

- You might not be able to resell owing to the lack of a secondary market

- There is usually limited to no protection if the platform itself goes bankrupt

Lending Loop Reviews

In this section, we are going to look at Lending Loop reviews from around the web.

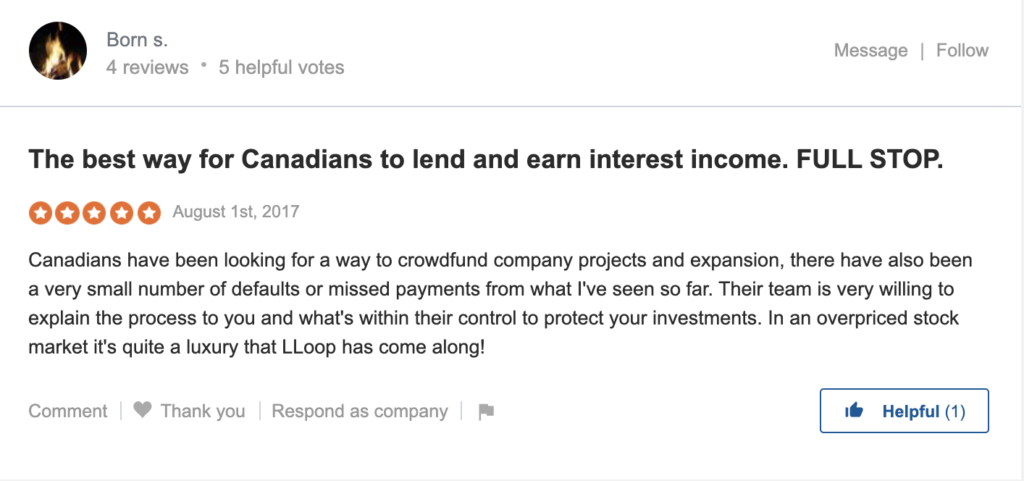

Lending Loop Positive Review

You can read more Lending Loop reviews here

Lending Loop Negative Review

Lending Loop Customer Support

Lending Loop has an active customer support team that can be reached to solve any queries or concerns.

You can reach Lending Loop customer support via the following channels. Lending Loop also has a detailed help section that has answers to common queries. You can access the help section below.

Lending Loop Phone Number : 888-223-5667

Lending Loop Email Address: contact@lendingloop.ca

Lending Loop Address:

410 Adelaide St W

Toronto, ON

M5V 1S8

Lending Loop Hours: Lending Loop customer support is available 9-6, Monday to Friday.

Lending Loop Social Media Handles

Lending Loop is active on most social media channels. If you want to follow Lending Loop on social media or get in touch with Lending Loop via social media, you can use these official handles.

Is Lending Loop Safe

As a platform Lending Loop is safe as the company has been in operation from 2014 and has disbursed more than $80 Million CAD in loans to small businesses in Canada. However, no Peer to Peer lending platform is 100% safe and when you get more interest for your investment, there is obviously more risk.

Lending Loop Quebec

Please note that as of December 2021, Lending Loop is not available to residents of Quebec, Canada. This is due to regulatory concerns in Quebec and to know when Lending Loop becomes available in Quebec, you can fill this official form.

Lending Loop Alternatives

If you are looking for Lending Loop Alternatives, you can consider some of these other platforms.

Since Lending Loop only provides loans for businesses you can use these platforms as alternatives as they specialize in personal loans

You can also consider Lending Club.

You can also consider Lendfield as an option but it should be noted that it work on the crowd-lending model.

Frequently Asked Questions About Lending Loop

Is Lending Loop Legit

Yes, Lending Loop is a legit business and has been in operation from 2014 and has disbursed more than $80 Million CAD in loans to small businesses in Canada.

Is Lending Loop Scam?

No, Lending Loop is not a scam but a genuine Peer to Peer lending company.

How do I withdraw money from lending loop?

Login to Lending Loop, go to “Transactions” on the left sidebar, then click on Withdrawals.

Is peer-to-peer lending legal in Canada?

Yes, as of December 2021, peer to peer lending is legal in Canada.

Why Peer-to-peer lending is bad?

Peer to Peer lending gives higher returns but there is a higher risk as well.

What are some of the risks of P2P Lending?

Interest payment default, Principal payment default & Concentration risk.

Related Reads

10 Easy Ways to Make Money Online in Canada

Business Analyst Jobs: Salary, Qualifications, Best Sites to Find BA Jobs in Canada

Instant Approval Credit Cards for Bad Credit Unsecured Canada

12 Best Paying Entry Level Work from Home Jobs That Require No Special Qualifications

Side Hustles to Help You Make Money Online

How to Earn Money from YouTube [Step By Step Guide]

10 Easy Ways to Earn Money Online

How to Earn Money from Facebook [Step By Step Guide]

Best Work from Home Jobs to Earn Money Online

12 Best Paying Entry Level Work from Home Jobs That Require No Special Qualifications

How to Start Blogging and Make Money

Lending Loop

Lending Loop Summary

Lending Loop is a peer to peer (P2P) lending platform based out of Toronto, Canada. While P2P lending looks like a good investment opportunity to earn some money, there are many risks associated with it. If you have surplus capital and you can take the risk–you can consider investing in a platform like Lending Loop. If you cannot afford to risk your money, I would not recommend P2P lending.

Overall

4-

Lending Loop

Pros

- Lending Loop is fairly easy to navigate and setting up your profile is also hassle free

- The platform also makes your investing decisions easier for you through the auto lend platform.

- You get a chance to invest into small businesses and give them a boost.

- Lending Loop gives you an unparalleled opportunity of earning money through some of the highest interest rates.

- It is a legitimate and fully regulated money lending platform, all the transactions are transparent.

- It works as a platform that helps you diversify your investment portfolio

- You can refer the platform to your family and friends and both the parties will get $25 if your referrals invest at least $1,500

- In case of any disputes you are eligible for the resolution of the same via the trusted Ombudsman for Banking Services and Investments.

Cons

- If borrowers are unable to keep making payments and default, lenders lose money and aren’t covered by the positive guarantee schemes such as the FDIC in the United States

- Your money will be locked in for as long as it takes for loan repayment.

- You might not be able to resell owing to the lack of a secondary market

- There is usually limited to no protection if the platform itself goes bankrupt