Last Updated on 2 years ago by Anoob P T

Are you interested in Simplii Financial Online Banking? In this post we are going to look at Simplii Financial Online Banking’s Products, Fees, Pros, Cons & Reveiw.

Simplii Financial is an online-only bank in Canada and offers a wide variety of services including credit/debit cards, mortgages, high interest savings accounts & No-Fee Chequing Account.

As someone who earns a full-time income online, I do lot of research about new financial products and institutions.

You can also check out our post on How to Buy DogeCoin in Canada if you are interested.

Simplii Financial Online Banking: Products, Fees, Pros, Cons & Reveiw

Table of Contents

What is Simplii Financial?

Simplii Financial is an online banking platform in Canada started in 2017.

Simplii Financial is part of the CIBC or Canadian Imperial Bank of Commerce.

The platform provides day-to-day service like banking accounts, chequing, savings, mortgages and investment products.

Simplii Financial came into existence after CIBC and Loblaw companies (the supermarket chain) decided to end the joint-venture that was providing consumer banking services by the name of President’s Choice Financial brand.

Official website of Simplii Financial: https://www.simplii.com/en/home.html

Simplii Financial Online Banking Sign In or Login

If you already have an account with Simplii Financial, logging into your account is very easy.

To Sign into Simplii Financial Online Banking, visit this official link and click on Sign On at the top right bottom of your screen.

If you do not have an account Simplii Financial Online Banking, you can sign up using this official link and get started easily.

Simplii Finanical App

Simplii Financial has an app that can be downloaded and installed on your Android and iOS phones.

To download official Simplii Financial apps you can use these official links from the app store.

Who Owns Simplii Financial?

Canadian Imperial Bank of Commerce is owner of Simplii Financial.

Prior to 2017, there was a financial institution under the name President’s Choice until CIBC and Loblaw mutually decided to end their 20-year joint-venture.

This paved way for CIBC to launch a new banking institution under the name Simplii Financial.

Simplii Financial Institution Number

Simplii Financial Transit Number or Routing Number

Simplii Financial SWIFT code

Simplii Financial Debit Card

Simplii Financial offers a Cash Back Visa Card as part of thier offering which has many benefits compared to other debit cards.

As of 2022, Simplii Financial Debit Card has a Welcome offer which provides users enjoy 10% bonus cash back at restaurants and bars up to $500 spend for the first 4 months.

After the first 4 months, users get 4% cash back.

Some of the features if Simplii Financial Debit Card include great rewards, zero annual fee and ability to add up to 3 card holders to earn extra cashback.

Some of the other benefits of Simplii Financial Debit Card include ability to pay bills online, send money abroad, pay with phone and fraud protection and alerts.

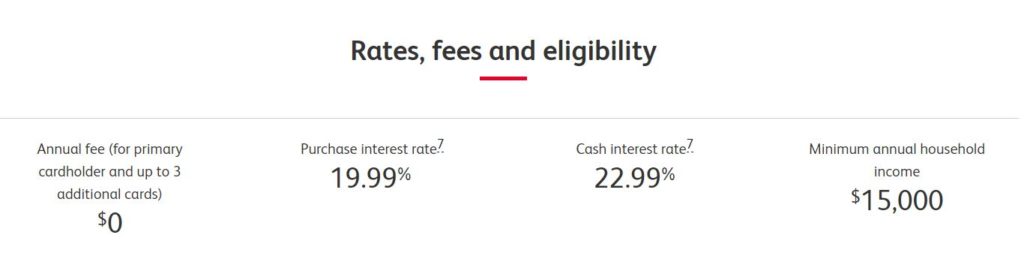

Simplii Financial Debit Card rates, fees and Eligibility

To get your Simplii Financial Debit Card, you can apply using this official link.

Types of Services Offered by Simplii Financial

There are many different types of services offered by Simplii Financial which is aimed at different types of customers.

No-Fee Chequing Account:

This service offers unlimited and free debit transactions which comes with the user’s own debit card, banking transactions, bill payments, money withdrawals, deposits, Interac e-transfers and allows access to over 3,400 CIBC ATMs in Canada.

Also, no minimum balance is required for Simplii Financial No-Fee chequing account. Users can earn interest in one’s own chequing account balance (0.05-0.15%), get free personalized cheques and receive a $200 welcome bonus when opening a new Simplii Financial account.

Furthermore, features like direct deposit and mobile cheque deposit are accessible on Simplii Financial’s banking app, available on Apple, Google and Samsung.

High-Interest Savings Account:

Simplii Financial’s High-Interest Savings Account offers a 0.10% interest rate.

Do note, interest rates can sometimes vary due to higher promotional rates for new accounts for a few months.

This service provides benefits like no requirement of minimum balance, no monthly fees and automatic savings plan.

Simplii Financial also offers other types of savings accounts.

For registered users, Simplii Financial Tax-Free Savings Account(TFSA) and Registered Retirement Savings Plan(RRSP).

For non-registered users, Simplii Financial savings account and Simplii High-Interest Savings Account(HISA).

Simplii Financial Credit Card:

Simplii Financial now offers a cashback Visa card.

The bank offers a lot of services for a n-fee card especially for those who use cards on a daily and a frequent basis.

The service includes features like no annual fee, free purchase security and extended warranty insurance.

The cashback program provides 0.5% cashback on all purchases, 1.5% on gas, groceries and drugstores purchases, and 4% on eligible restaurants, bars and coffee shops.

The annual percentage yield (APR) for Simplii Financial’s Cash Back Visa Card is currently 19.99%.

Mortgages:

Simplii Financial offers variable and fixed-rates mortgages at competitive rates. Simplii Financial recently introduced a mortgage borrowing option ranging from 2-year to 5-year terms and the rate ranging from 1.34% to 2.24%.

Another interesting feature to know about Simplii mortgage services is that Simplii covers the appraisal fee and guarantees 120 days fee if you are transferring mortgage from another bank to Simplii

Investment Options:

Simplii Financial offers two investing options:

Guaranteed Investment Certificate (GICs) and Mutual Funds.

The platform has seven index mutual funds for a registered account (TSFA, RRSP, RRIF and RESP) or a non-registered account.

CIBC Securities made these funds available which include risks and objectives. The index-fund portfolios are as follows:

- Conservative: Conservative Income, Income, Income Plus

- Balanced: Balanced, Balanced Growth

- Growth: Growth, Aggressive Growth

Simplii Financial’s mutual funds require a minimum investment of $25, customers get a discount of 10 basis points on the fund’s management fee and Management Expense Ratio (MER) ranges from 0.95% to 1.12%.

The platform offers registered(TFSA, GICs and RRSP GICs) and non-registered accounts GICs. Simplii Financial’s GICs range from 1-year to 5-year with renewability options and laddering as an investment option.

Simplii Financial’s GICs require a minimum investment of $100 and rates ranging from 0.49% to 1.50% which are protected by CDIC up to $100,100.

Personal Loan:

Simplii Financial offers a secured line of credit, personal line of credit and personal loans. For the secured line of credit, there is one time set up fee of $150.

Global Money Transfer and Foreign Cash Service:

Simplii Financial’s Global Money Transfer service allows the user to easily send money without a transfer fee over a duration of 1-3 business days.

It is available for over 60 countries and has a limit of $30,000 in a 24-hour period.

For sending money the customer requires the recipient’s name and address, their bank’s name, address, bank account number and bank code.

This feature also includes a Foreign Cash Service. Offering cash in up to 65 currencies with a limit of $2,500 in a 24-hour period, you can get cash delivered at your home or the nearest post office.

Simplii Finanical Cheques

If you run out of cheques with Simplii Financial, you can reorder cheques online or call the bank at 1-888-723-8881 to get new cheques via mail.

Simplii Financial Fees

Before signing up for Simplii Financial, it might be good for you to know different fees that are charges by the bank.

As of 2022, these are Simplii Financial fees charged to customers.

- Stop payments: $10 – $16.50

- Money Order and Bank drafts: $7.50

- Overdraft fee: $4.97 minimum

- NSF fees: $45

- Stop Interac e-transfer: $3.50

- Non-CIBC ATM withdrawal (Canada): $1.50

- Non-CIBC ATM withdrawal (foreign): $3.00 or more

- Inactivity fee: $20 per year

- Foreign currency conversion: 2.5%

- TFSA or RRSP account transfer: $50 per transfer

Simplii Financial Pros

There are some pros that make Simplii Financial ideal if you are looking for an online-only bank in Canada.

Some of the pros of Simplii Financial include:

No fee: Simplii Financial doesn’t charge a fee for daily banking products including chequing and savings accounts.

Extensive variety of products: The platform offers a wide variety of saving and investing options. Simplii Financial makes it easier for the customer to pay, transfer, deposit etc with the comfort of home.

Low interest rates for borrowing: Simplii Financial borrowing interest rates are pretty low compared to other finanical institutions offering mutial funds, credit cards and mortgages.

Excellent Customer Support: Almost all users who have left reviews about Simplii Financial have mentioned the bank has excellent customer support. However, in the recent past, there have been some users who have also mentioned the quality of customer service has dropped.

Simplii Financial Cons

Like other online banks, Simplii Financial online banking services also has some cons which you should be aware of. These are some of the cons of Simplii Financial.

Minimal in-person interaction: Banks have traditonally been more about in-person human interaction and with banks like Simplii Financial, human interactions are almost non-existant which can prevent you from getting personalized services.

Cash deposits and daily limits: As with other online banks, cash deposit can sometimes become an issue because most online banks do not have physical branches. Also, there is usually limit on amount of money you can deposit to online banks at any given point in time.

Low-interest rates: Simplii Financial interest rates are not the best in the industry for savings accounts.

Simplii Financial Reviews

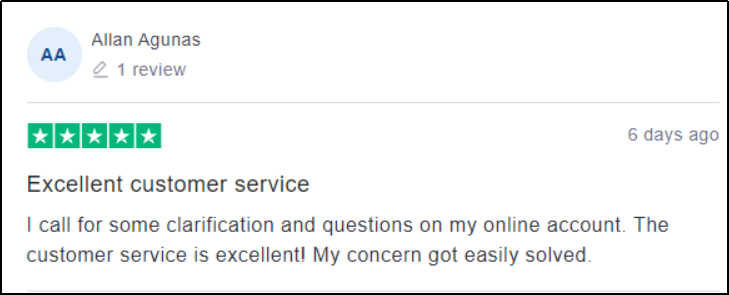

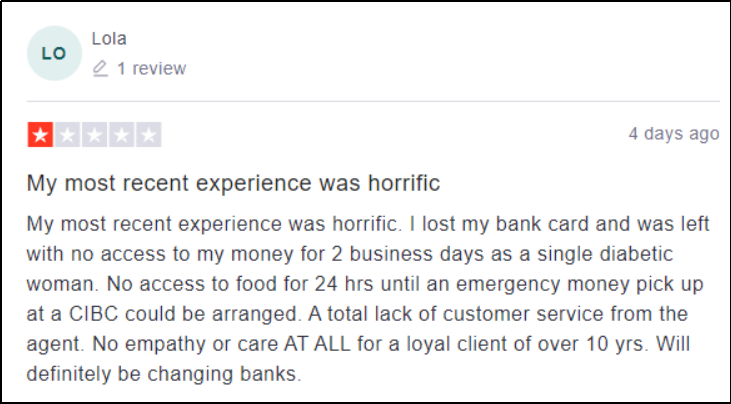

In this section, we are going to look at some Simplii Financial reviews which are available on the web.

We will also try to show you one positive and one negative review of Simplii Financial so that you get a general idea about Simplii Financial before signing up.

Many users have reported that Simplii Financial can be a hassle to use and most of the companits from users were that communication from the bank is not timely, adding or removing new features to an account can take a lot more than the expected time.

Also, there have been complaints that the online portal goes down from time to time.

On Review site TrustPilot, Simplii Financial poor with just 1.3 out of 5 stars from 239 reviews.

On the flip side, many users have also mentioned that Simplii Financial is a convenient user-friendly platform and users have also left positive reviews about obtaining credits.

Fees are comparable with other providers so if you are looking for an online banking service, you could give Simplii Financial a try–but ensure you understand the terms and conditions and the fees of your account really well.

Simplii Financial Positive Review

You can read more Simplii Financial reviews here

Simplii Financial Negative Review

You can read more Simplii Financial reviews here

Simplii Financial Customer Contact Information

Simplii Financial does have a customer support team that can resolve all your queries and concerns.

Initailly, Simplii Financial was known for excellent customer support but lately many users have raised complaints that Simplii Financial customer support is taking lot of time to respond to queries.

You can get in touch with Simplii Financial customer support team via these channels.

Simplii Financial Live Secured Chat: Live Chat (Availability:- Monday to Friday: 7:00 am to 12:00 am ET; Saturday, Sunday and holidays: 9:00 am to 6:00 pm ET)

For General Inquiries:

Simplii Financial Phone Number: 1-888-723-8881 (Toll Free, available 24/7)

Simplii Financial Estates Support: 1-877-433-1907 (Toll Free, available Monday to Friday: 9:00 am to 6:00 pm ET)

Simplii Financial Email: talktous@simplii.com

Simplii Financial Mortgage Team: 1-888-866-0866

Report a lost or stolen card: 1-888-723-8881

Provide comments or concerns: 1-888-723-8881

Simplii Financial Social Media Handles

As a digital-only bank, Simplii Financial is active on most social media channels.

If you want to follow Simplii Financial on social media, you can do so using these official handles.

You can also raise your concerns on these social media channels to get a faster response from the Simplii Financial team.

Simplii Financial Alternatives

There are many online-only banks which can be considered as a good alternative to Simplii Financial.

Some of the more popular Simplii Financial alternatives include.

Frequently Asked Questions about Simplii Financial Online Banking

What is CIBC Simplii?

Simplii Financial is the direct banking brand of the Canadian Imperial Bank of Commerce (CIBC).

Are Simplii Cheques free?

Yes, personalized cheques issued by Simplii are free.

Does Simplii Financial have overdraft?

Yes, Simplii Financial does have overdraft facility.

Is Simplii financial safe?

Yes, Simplii Financial is safe because it is part of CIBC and your funds are secured under CIBC.

Can Simplii use CIBC tellers?

Yes Simplii users can use CIBC tellers or ATMs in Canada for free.

Is Simplii financial an online bank?

Yes, Simplii Financial is an online bank with no monthly fees.

Does Simplii Financial have a Visa debit card?

Yes, Simplii Financial has a Visa debit card with no annual fee. You can also add up to 3 additional cardholders and earn more cashback.

Does Simplii have a debit card?

Yes, Simplii Financial does have a cashback Visa debit card.

Is Simplii part of CIBC?

Yes, Simplii or Simplii Financial is a part of CIBC

How do I activate my Simplii debit card?

You can activate Simplii debit card using the Tap Functionality or you can call 1-888-723-8881 to activate your Simplii Financial debit card.

Are PC Financial and Simplii the same?

Around two million clients who had PC bank accounts were moved to Simplii Financial, a new digital bank owned by CIBC.

How long does Simplii financial hold Cheques?

Up to 5 business days.

Recommended Reads

6 Free & Best Chequing Account Canada Banks Can Offer You in 2022

10 Easy Ways to Make Money Online in Canada

Instant Approval Credit Cards for Bad Credit in Canada

How to Write a Cheque in Canada: A Step-by-Step Guide

Lending Loop Review: Pros, Cons & Fees of Peer-to-Peer Lending in Canada in 2022

10 Easy Ways to Make Money Online in Canada

Simplii Financial

Simplii Financial Summary

Overall, Simplii Financial has only 2.5 Star Rating out of 5. Many users have reported that Simplii Financial can be a hassle to use and most of the companits from users were that communication from the bank is not timely, adding or removing new features to an account can take a lot more than the expected time. However, many users have also mentioned that Simplii Financial is a convenient user-friendly platform and users have also left positive reviews about obtaining credits. Fees are comparable with other providers so if you are looking for an online banking service, you could give Simplii Financial a try–but ensure you understand the terms and conditions and the fees of your account really well.

Overall

2.5-

Simplii Financial

Pros

- No fee: Simplii Financial doesn’t charge a fee for daily banking products including chequing and savings accounts.

- Extensive variety of products: The platform offers a wide variety of saving and investing options. Simplii Financial makes it easier for the customer to pay, transfer, deposit etc with the comfort of home.

- Low interest rates for borrowing: Simplii Financial borrowing interest rates are pretty low compared to other finanical institutions offering mutial funds, credit cards and mortgages.

- Excellent Customer Support: Almost all users who have left reviews about Simplii Financial have mentioned the bank has excellent customer support.

Cons

- Minimal in-person interaction: Banks have traditonally been more about in-person human interaction and with banks like Simplii Financial, human interactions are almost non-existant which can prevent you from getting personalized services.

- Cash deposits and daily limits: As with other online banks, cash deposit can sometimes become an issue because most online banks do not have physical branches. Also, there is usually limit on amount of money you can deposit to online banks at any given point in time.

- Low-interest rates: Simplii Financial interest rates are not the best in the industry for savings accounts.