Last Updated on 1 year by Anoob P T

Are you looking for UpStox Review? This is my unbiased UpStox Review based on sign up process, pros, cons, features of UpStox, fees, customer support & UpStox coupon code.

UpStox is a trading platform that charges low brokerage fees and gives high margins on the trading of stocks, mutual funds, digital gold, and IPOs.

Millions of people are using UpStox to trade stocks and making money and some people are even making passive income using UpStox.

If you are interested in the whole concept of making money online, you can check out some of my other posts including 10 Easy Ways to Earn Money Online without Investment, How to Earn Money from YouTube, how to earn money from Facebook and how to start a blog and make money.

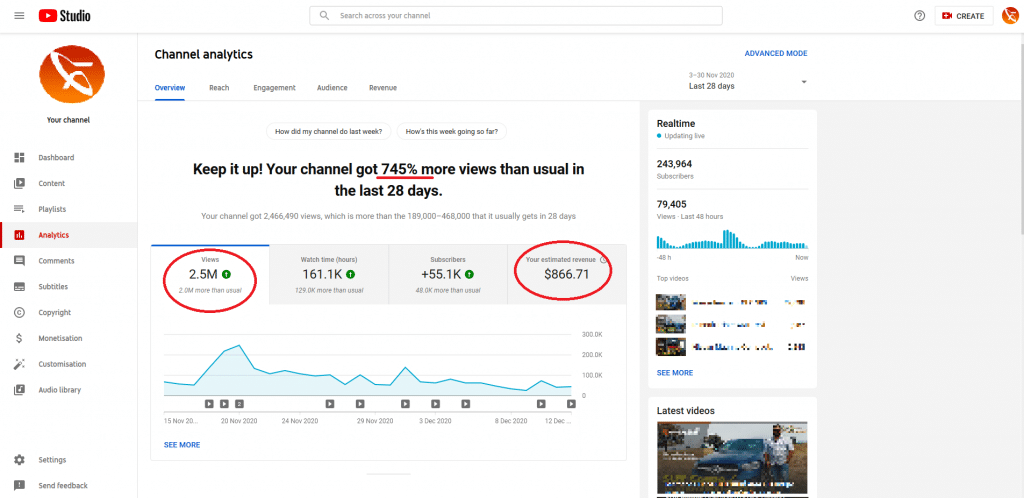

I recently helped a client of mine generate $1000 in income from his YouTube channel that was not making any money and even you can do the same.

Earlier, I had co-founded a video company and raised $2 million in funding and then got fired from the company I started. I had done lot of testing and research on how to monetize YouTube and now I use the same skills to help other YouTubers.

You can read my full story here if you are interested.

UpStox Review: Pros, Cons, Features, Fees & Coupon Code

Table of Contents

What is UpStox?

UpStox is a trading platform that charges low brokerage fees and gives high margins on the trading of stocks, mutual funds, digital gold, and IPOs.

The platform has been designed in a simple way so that beginners, as well as experts in trading, can use the platform. You can also customize as per your need and convenience.

Official website of UpStox: https://upstox.com/

Benefits of UpStox Account

UpStox is one of the newer, tech enabled trading platforms that has gotten very popular in the recent past.

Having a UpStox account comes with the following benefits:

- Low-cost trading- UpStox does not charge any brokerage fees when you trade on the platform

- Fixed fee- UpStox charges only ₹ 20 per day regardless of the amount you trade

- Easy account opening- Opening an account on UpStox is easy and safe. The whole process starting from application to verification usually takes 2-3 days.

- Added functions- UpStox provides brokerage calculator, SPAN calculator, and options builder added in the interface for added ease of use

- Customer service- When you make a call to the customer service, the calls are attended to within 30 seconds. This makes them one of the fastest customer service among others

- Backed by established companies- With investors like Ratan Tata and Tiger Global Management, UpStox is a trusted platform where your money and stocks shall be secured

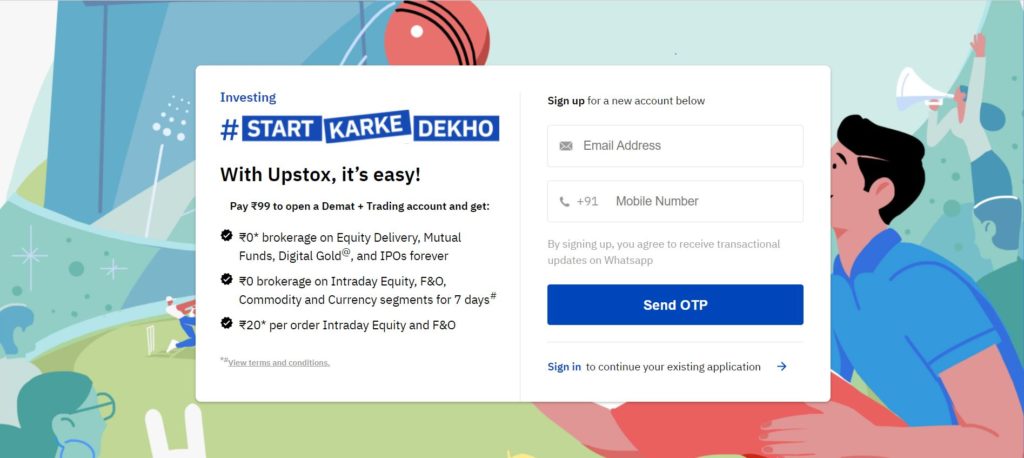

How to Open An UpStox Account

Opening an UpStox account is a farily simple process.

Simple go this official UpStox Account opening link and fill in your details.

You will have to give your valid mobile phone number, PAN card, Government ID Proof and some basic details and you can quickly get started.

You should also know there is a INR 99 fee to open an UpStox account.

UpStox Annual Charges

UpStox charges a one-time fee of ₹ 99 when opening an account.

Hereafter, it charges ₹ 25 plus GST every month as account maintenance charges.

For HUF, Trading Account Charges: ₹150 + GST = ₹177

Demat Account Charges: ₹150 + GST = ₹177 (AMC)

For LLP- Account Opening Fees LLP

Trading Account + Demat AMC: ₹500 + ₹1000 + GST = ₹1770/- (non-refundable)

Demat AMC 2nd year onwards: ₹1000 + GST = ₹1180/- (non-refundable)

It has no other annual charges involved.

To know more about UpStox annual charges, you can check the official link here.

UpStox Brokerage Charges

UpStox charges no brokerage charge on stock delivery.

The platform has a flat fee of ₹ 20 per day no matter how much amount you trade.

Other than that there are no hidden charges involved.

UpStox Coupon Code

As of August, 2021 UpStox Coupon Code is not required to join UpStox and get sign up bonus.

You can use this official UpStox link to sign up and start trading.

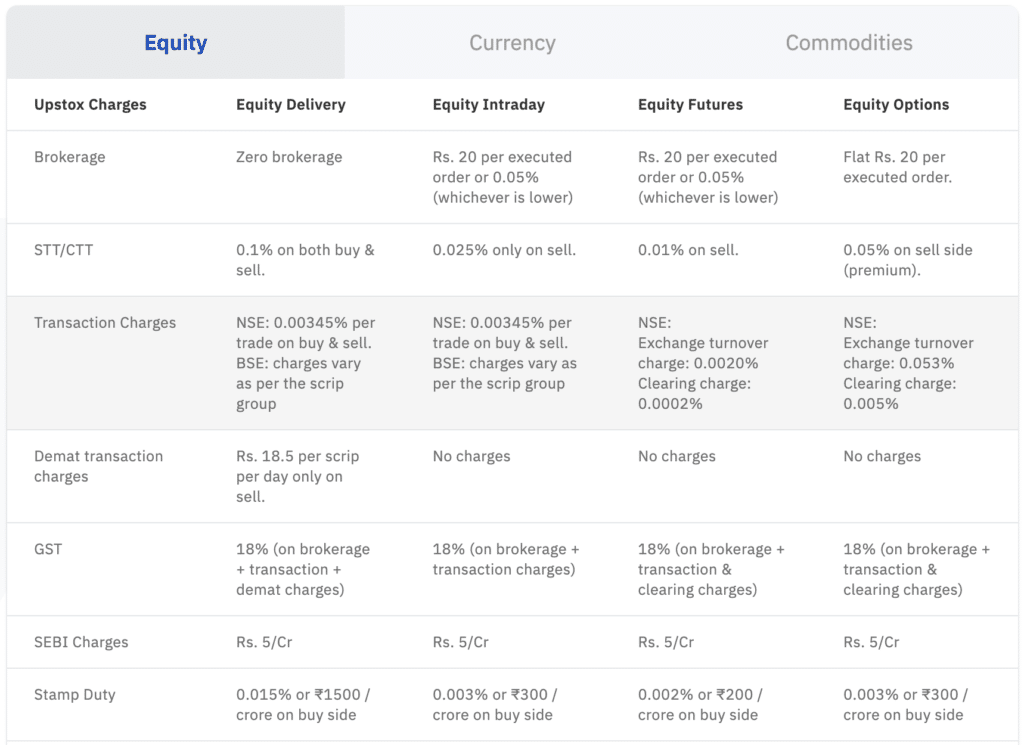

UpStox Fees

UpStox charges no fees for trading. However, there are some fees that UpStox charges for Equity, Currencies and Commodities.

UpStox Fees for Equity

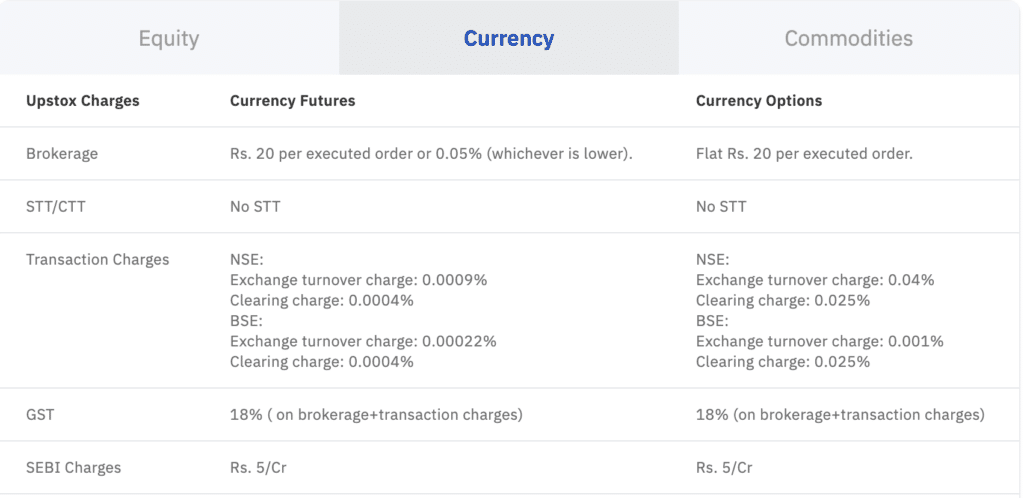

UpStox Fees for Currencies

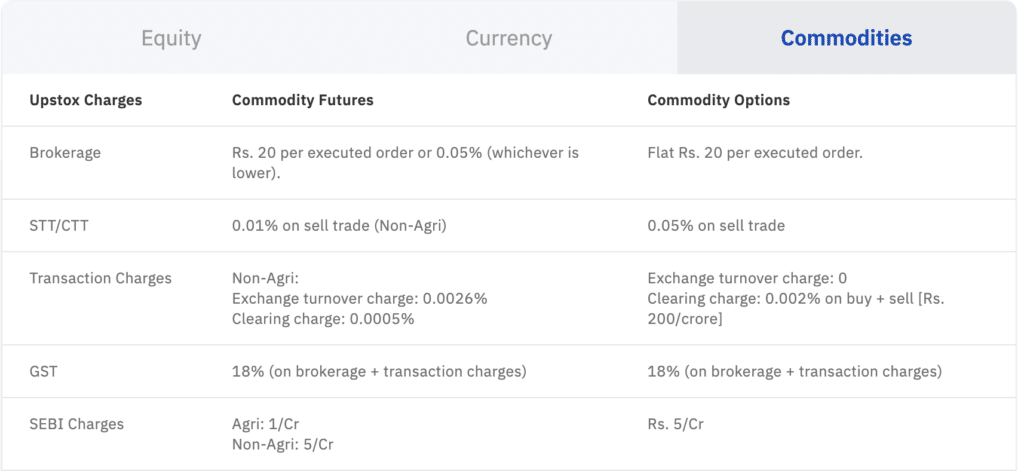

UpStox Fees for Commodities

To know more about UpStox fees, you can check this official link.

UpStox Pro

UpStox Pro is an upgrade from the basic UpStox plan. This plan has the following advanced features:

- It has better charting features than the basic plan

- It offers customization options

- One search bar for all search needs

- It frequently updates the product stock prices

- The trading process is faster as compared to the basic plan

- Has a mobile app that offers flexibility

- Can open 4 charts in the same window

- Create many price alerts

- Gives instant updates on any changes

- Offers equity trading at BSE and NSE

- Offers commodity trading at MCX

- More than 100 technical indicators in charts

- Can directly place orders from charts

- Can trade in Algo Trading

- Gives access to predefined watch-list of Nifty 50 and other stock indices

Upstox Types of Account

Trading Account

About Trading Account

In a trading account you store the cash that is to be used for trading. To enter the stock market, a trading account is required. UpStox Trading Account is one of the easiest accounts to operate.

Benefits of UpStox Trading Account

An UpStox Trading Account comes with the following benefits:

- Less brokerage charge allows you to use more cash to trade

- Gives better leverage when trading intraday

- Free delivery trading

- Allows monitoring price in real time

- Advanced charting tools provides with realtime market data

- Allows trading across multiple asset classes

- One single account to trade across all segments

- Can monitor profits with various customized watchlists

- Allows easy transfer of funds to and from bank account and trading account

- Can place order on one click

Charges of Trading Account

The charges of maintaining a UpStox Trading Account are ₹150 on Equity segments on NSE and BSE. It has no annual maintenance fee.

3 in 1 Account

About UpStox 3 in 1 Account

UpStox 3 in 1 Account is an account that combines the features of a Demat, Trading, and Savings Bank account. It is beneficial to have a 3 in 1 account because it allows you to enjoy the benefits of all 3 types of accounts.

Benefits of UpStox 3 in 1 Account

An UpStox 3 in 1 Account comes with the following benefits:

- There is no hassle in transferring funds within the 3 accounts

- There is no limit on the fund transfer

- Free fund transfer

- The account number can be customized as per your choice

- No charge is levied on account opening

- No minimum balance requirements

- Gives interest on the funds that is used from the savings account to trade

- Also gives additional interest on savings account balance

- Does not charge any brokerage on equity deliveries

- Allows 10 calls per month to be made to use the “Call N Trade” feature

- Gives rewards on transactions made through the debit card linked to your savings account

- The rewards can be further used to trade stocks

Charges of 3 in 1 Account

UpStox 3 in 1 Account charges no fees on equity deliveries. For Intraday transactions ₹ 20 per order or 0.01%, whichever is lower. For Future Trading a charge of ₹ 20 or 0.01% per order. If you want to trade using the Options Trading, ₹ 20 is charged as the fee.

Upstox Priority Pack Plan

About Upstox Priority Pack Plan

UpStox Priority Pack Plan is for those Intraday traders who want higher leverages. The trading margin offered is higher than the margin that the basic plan offers.

Benefits of Upstox Priority Pack Plan

The benefits of signing up with UpStox Priority Pack Plan are:

- Gives 2 times Intraday leverage when buying with Closing Offset, One Cancels the other Order, or Bracket Order

- Gives upto 28 times leverage on index future when buying with Closing Offset, One Cancels the other Order, or Bracket Order

- 6 times more leverage on stock futures

- 27 times Intraday leverage on cash

Difference Between Upstox Priority vs Basic Plan

UpStox Basic Plan is good for those who are beginners or have at least some experience in trading.

UpStox Priority Plan is for those who are looking for a higher margin while trading and have more experience in trading.

Charges

Brokerage charges on the Basic Plan is ₹ 20 per trade, whereas in the Priority Plan it is ₹ 30 per trade.

There is an additional charge of ₹ 999 per month in the UpStox Priority Plan for Equity, FO, and Currency. There are no such charges in the Basic Plan.

Additionally, there is also a charge for commodity fixed at ₹ 499 per month. There are no such charges in the Basic Plan.

Margin

When you pay the extra charges, you get a higher margin.

The following table shows the margin of various commodities while on the Basic Plan and on the Priority Plan

| Segment | Basic Plan | Priority Plan |

| NSE/BSE Cash | 15X | 20X |

| Stock Futures | 3X | 6X |

| Stock Option Sell | 3X | 3X |

| Index Option Sell | 3X | 6X |

| Index Futures | 3X | 6X |

| MCX Future | 2.5X | 3X |

| NSE Currency | 4X | 4X |

From the table, it is very clear that there is a higher margin in the Priority Plan.

Margin OC/OCO orders

To see the Margin on OC/OCO orders, let us look at the following table

| Segment | Basic Plan | Priority Plan |

| NSE/BSE Cash | 20X | 27X |

| Stock Futures | 5X | 6X |

| Stock Option Sell | 3X | 3X |

| Index Option Sell | 3X | 4X |

| Index Futures | 20X | 28X |

| MCX Future | 3X | 4X |

| NSE Currency | 4X | 5X |

| NSE Option Buy | 1.33X | 2X |

RKSV (Upstox) Demat & Trading Account Features

Low Brokerage Charges

This feature gives it a huge advantage for those who are starting on their stock trading journey. Under the Basic Plan, there is a flat brokerage charge of ₹ 20. This allows people to use more of their money for trading instead of paying heavy fees for brokerage.

This is also great for people who want to experiment with trading in different segments.

Because of a flat fee, the customer can trade as little as he wants to as much as he wants without worrying about the brokerage fees.

People who have a bit more experience with stock trading and can handle higher leverages can choose the Priority plan.

The Priority plan has more benefits. The charge in this plan is ₹ 30. The charge may seem high but are comparatively lower than other similar brokers.

Trading Margins

Margins are essential when you trade multiple times in a day with your total money. To understand this better, let us see an example. If you keep ₹ 5000 in your trading account, and you get 10X leverage. Hence, you get 5000 X 10X leverage, i.e. ₹ 50,000.

Under the Basic Plan, RKSV gives 15X margin and 20X margin when under the Priority Plan.

For someone who is just starting their trading journey, the 15X leverage under the Basic plan protects him from the risks because he enters with a higher leverage.

Account Opening Annual Charges

Account opening charge in UpStox is free of cost under the current offer. After the offer ends, there is a one time charge of ₹ 199.

You also need to pay ₹ 25 each month as maintenance charges.

Upstox vs Zerodha Basic Comparison

Both UpStox has a one time fee of ₹ 199 when opening an account while Zerodha charges ₹ 200 for opening an account. Both the platforms charge ₹ 300 as annual maintenance charge.

Intraday Equity, Future Equity, Currency Futures, and Commodity Futures all have brokerage of ₹ 20 or 0.03%(whichever is lower) in UpStox, while for Zerodha it is ₹ 20 or 0.05%(whichever is lower).

For Commodity Options, the brokerage is ₹ 20 per executed order or 0.03% for UpStox, while it is ₹ 20 per executed order for Zerodha.

Minimum brokerage charge is 0.03% for Intraday and F&O in UpStox. It is 0.05% in Zerodha.

UpStox IPO

UpStox also offers tradings in IPO.

To trade in IPO, you have to first select an IPO which its applications open. Next, you need to add upto 3 bids within the price range. After confirming your application, the process will be completed.

You can also block funds for IPO on the mobile UpStox application.

UpStox Pros

- Easy Account Opening

- Low brokerages

- Trade with Equity, Commodity and Currencies

- Different types of Account for your needs

- Backed by big names such as Ratan Tata

UpStox Cons

- Good Till Cancelled (GTC) and Good Till Date/Time orders are available only in commodity trading.

- There is a INR 20 Call & Trade Fee

- Brokerage free trading is applicable for Equity Delivery segment under the basic plan.

- Under basic plan, Demat transaction charges are payable only brokerage is free.

- As of now UpStox does not provide stock tips or suggestions available.

- Customer support is sometimes slow to respond.

- No API access for automated trading.

UpStox Reviews

Is UpStox Safe

UpStox is backed by reputed names like Ratan Tata, Kalaari Capital, and GVK Davix.

UpStox also is one of the most popular discount brokers in India. It has a user friendly interface which makes it easy for anyone to use. This makes the whole process faster by reducing the time to find the right option.

UpStoc has recently crossed the 10 lakh user milestone making them the second biggest discount trading broker in India.

UpStox AMC charges

Annual maintenance charges for maintaining a Demat account in UpStox is ₹ 300. There is no annual maintenance charge for a trading account.

How to Close UpStox Account

To close your UpStox account you need to do the following steps:

- Go to www.upstox.com

- In the top menu bar, select the ‘Support’ option

- Then select ‘Download Forms’

- Select the ‘Account Modification Forms’

- Here you will find the ‘Demat Account Closure’ form option

- Print the form, fill and sign it

- Lastly, you have to send the filled form to the ‘Correspondence Office’ address that is mentioned on the form

- After they accept your application, your account will be closed

UpStox Customer Contact Information

UpStox Customer service can reached via the following numbers within 9 AM to 11 PM on all days including weekends

022 4179 2991

022 6904 2291

022 7130 9991

You can chat with UpStox customer support representative using this official link.

You can also raise a customer support ticket using this official link.

UpStox Customer Contact Email id is: You can also reach out to them via email. Their email is new.account@upstox.com

UpStox Social Media Channels

UpStox is active on most social media channels. If you want to know latest offers from UpStox or want to follow what the company, you can do so using official UpStox social media handles listed here.

Frequently Asked Questions about UpStox

Is Upstox funded by Ratan Tata?

Yes, UpStox is funded by Ratan Tata who owns about 1.33% of the company.

Is Upstox trusted?

Yes UpStox is a legit discount broking company that is used by millions of people everyday.

Who is owner of Upstox?

Founders of RKSV Securities (UpStox) are Ravi Kumar, Raghu Kumar and Shrinivas Viswanath.

Is Upstox an Indian company?

Yes UpStox is an Indian discount broking company

Is Upstox SEBI registered?

RKSV or UpStox is a member of NSE, BSE, and MCX exchanges, and is registered with the Securities & Exchange Board of India (SEBI) as a stock broker with the SEBI registration numbers Member Code: 46510

Is demat account free in Upstox?

There is a INR 99 Account Opening Fee and annual maintenance fee.

Can I earn money from Upstox?

Yes, you can earn money from UpStox by trading in stocks.

How much does Upstox cost per year?

Trading account will cost INR 249 per year.

Recommended Reads

Side Hustles to Help You Make Money Online

How to Earn Money from YouTube [Step By Step Guide]

10 Easy Ways to Earn Money Online

How to Earn Money from Facebook [Step By Step Guide]

Best Work from Home Jobs to Earn Money Online

12 Best Paying Entry Level Work from Home Jobs That Require No Special Qualifications

How to Start Blogging and Make Money

UpStox Review

UpStox Summary

UpStox is a trading platform that charges low brokerage fees and gives high margins on the trading of stocks, mutual funds, digital gold, and IPOs. As of August 2021, UpStox is one of the best and most popular discount brokers in India with millions of people trading on the platform. You can safely use UpStox and go for their beginner plan and later upgrade if you feel like.

Overall

4.5-

UpStox Review

Pros

Easy Account Opening

Low brokerages

Trade with Equity, Commodity and Currencies

Different types of Account for your needs

Backed by big names such as Ratan Tata

Cons

There is still an annual maintenance charge

Good Till Cancelled (GTC) and Good Till Date/Time orders are available only in commodity trading.

There is a INR 20 Call & Trade Fee

Brokerage free trading is applicable for Equity Delivery segment under the basic plan.

Under basic plan, Demat transaction charges are payable only brokerage is free.

As of now UpStox does not provide stock tips or suggestions available.

Customer support is sometimes slow to respond.

No API access for automated trading.