Last Updated on 1 year by Anoob P T

Are you looking for Oaken Financial reviews? In this post we are going to look at different types of accounts offered by Oaken Financial, fees, how to open an account with Oaken Financial and whether Oaken Financial is safe or not.

Before we get to Oaken Financial Reviews, we have also written detailed posts about easy ways to make money online in Canada and a step by step guide on how to write a cheque in Canada. Do check these posts if it interests you.

You can also check our post on Instant Approval Credit Cards for Bad Credit in Canada if you are looking to get a credit card and your credit history is bad.

Table of Contents

What is Oaken Financial?

In the past few years, there have been a lot of “digital only” banks that have been established and doing well and Oaken Financial is one such online bank in Canada.

Oaken Financial like other digital only banks offers high-interest savings accounts and GICs or Guaranteed Investment Certificates.

There are many digital only banks such as Tangerine, Motive Financial, EQ Bank that also offer similar products and services such as Oaken Financial, you can check them out too.

COVID-19 has shown the importance of digitization across different aspects of life and the only businesses that are thriving right now are the ones that have some digital presence.

Digital or Online banks have the advantage that they do not need to have physical addresses which reduces the cost and they are able to pass on some of this benefit back to the customer.

This is why banks such as Oaken Financials and Tangerine are able to provide their customers with better savings rates and provide chequing account services without any monthly or quarterly fees.

Oaken Financial is part of the Home Bank which is a subsidiary of the Home Trust Company which was founded in 1987.

Oaken Financial Physical Offices

As Oaken Financial is an online bank, they have a very limited number of physical offices mainly in cities of Vancouver, Calgary, Toronto, Halifax.

Oaken Financial Vancouver Office Address

Address: 200 Granville St #1288, Vancouver, BC V6C 1S4, Canada

Oaken Financial Calgary Office Address

Address: 517 10 Ave SW, Calgary, AB T2R 0A8, Canada

Oaken Financial Toronto Office Address

Address: Concourse Level, 145 King St W, Toronto, ON M5H 1J8, Canada

Oaken Financial Halifax Office Address

Address: 1949 Upper Water Street, Suite 101, Halifax, NS B3J 3N3

Oaken Financial: Types of Accounts

Oaken Financial offers two types of accounts, the savings account and GICs.

Oaken Financial Savings Account

Oaken Financial Savings Account is a high interest savings account that have the following features:

- No fees

- No minimum balance requirements.

- Oaken Savings Accounts are eligible for CDIC coverage, up to all applicable limits

Oaken Financial Guaranteed Investment Certificates

GICS are savings vehicles that guarantee your principal and interest during the time of investment.

At Oaken Financial you can invest in

Registered and Non Registered GICs and minimum investment amount is $1000

As of publishing this post, this is the GIC Rates of Oaken Financial.

For full GIC rates, please visit the link below.

https://oaken.com/gic-rates/

How to Open Oaken Financial Account

You can open Oaken Financial account my mail or by visiting one of their physical stores.

To open an Oaken Finiancial account by mail, you need to do the following steps:

- Download the form from the link below

- Fill the form and attach the supporting documents

- Send the form and documents to the address below

Address:

Oaken Financial

145 King Street West

Suite 2500

Toronto, ON

M5H 1J8

https://oaken.com/apply-by-mail/

If you are a new customer, you will need to provide your SIN (Social Insurance Number), two Identifications, a cancelled cheque & a personal cheque for $1 to verify your identity.

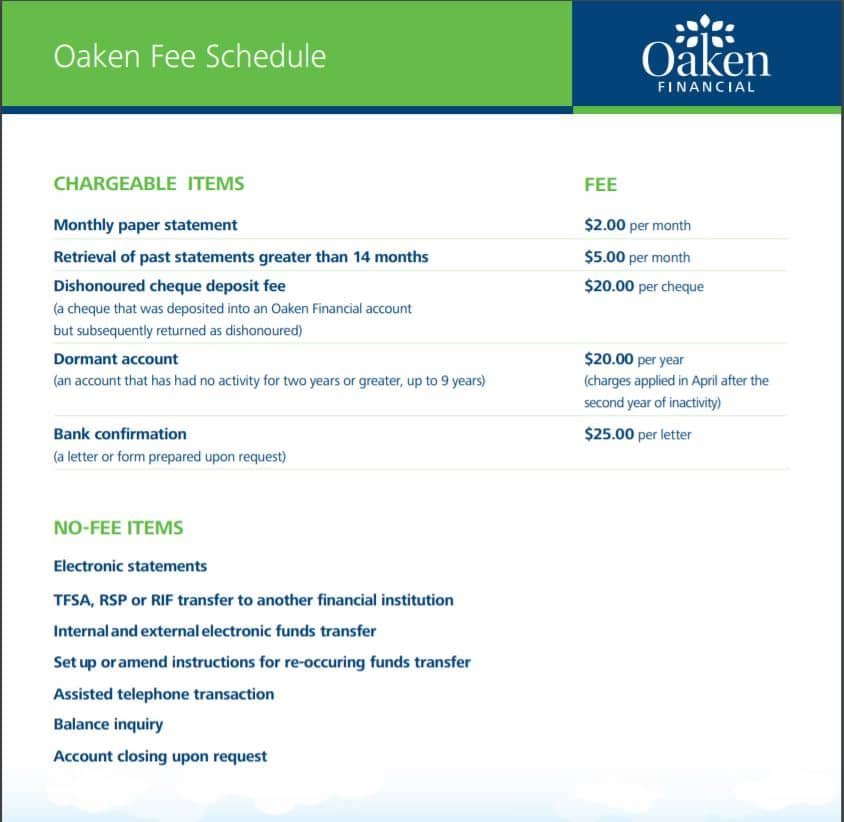

Oaken Financial Fees

As of publishing this post, these are the fees for Oaken Financials accounts.

You can download the full Oaken Financials Fees chart by visiting the link below.

https://oaken.com/wp-content/themes/oaken/assets/pdf/OAK_Fee+Schedule+Chart.pdf

Is Oaken Financial Safe?

All deposits at Oaken Financial are insured by Canada Deposit Insurance Corporation for up to $100,000 per category.

As we mentioned before Oaken Financial is a subsidiary of Home Bank and Home Trust Company, which are members of Canada Deposit Insurance Corporation.

Should You Choose Oaken Financial?

If you are looking for an online bank, then Oaken Financial can be a good choice because they offer high interest rates.

Do note Oaken Financial only offers a savings account and only investment options are GICs. If you need more flexible investment options, you can check out other banks such as Tangerine.

Oaken Financial Login

Oaken Financial does not have a mobile app, but you can login to Oaken Financial using the link below.

https://online.oaken.com/cb/pages/jsp-ns/login-cons.jsp

Oaken Financial Customer Support

For any questions or concerns, you can reach Oaken Financial Customer Support lines at 1-855-OAKEN-22 (625-3622), 8:00am to 8:00pm ET, Monday to Friday, or email service@oaken.com

Frequently Asked Questions on Oaken Financial

Is Oaken Financial Safe?

Yes, absolutely!

Who owns Oaken financial?

Home Trust

Is Home Bank a good bank?

Yes, its a good bank for all types of financial services.

When was Oaken financial launched?

2013

Recommended Reads