Last Updated on 2 years ago by Anoob P T

Are you looking for Motusbank review? In this post, we are going to look at Motusbank types of accounts, features, pros, cons and Motusbank fees.

Motusbank is a virtual bank in Canada that operates completely online. As someone who makes a full-time income from online sources, I too have accounts with multiple “online-only” banks.

Motusbank Review: Types of Accounts, Features, Pros, Cons, Fees

Table of Contents

What is Motusbank

Motusbank is a virtual bank in Canada that operates online. It offers its customers checking accounts with zero fee charged on interest. It also offers highly competitive personal loans and high interest saving accounts and mortgage rates.

The bank was launched in April 2019 by Meridian Credit Union and is a continuation of the fee cutting trend and the digitalization of Canada’s banking system.

Motusbank has membership with CDIC (Canada Deposit Insurance Corporation) so your deposits are safe with the bank.

It is a digital bank and does not have any brick-and-mortar locations.

Customers conduct the banking transactions online and can reach to the customer service centres through phone calls if required. The bank is available in all the provinces of Canada except Quebec.

Motusbank’s parent company Meredian Credit Union has been in existance for the last 75 years and is the largest credit union in Ontario and the 3rd largest in Canada.

It has more than 3,00,000 members and assets that amount to over $20 billion.

Official website of Motusbank: https://www.motusbank.ca/

Motusbank also has Android and IOS apps so that you can use banking facilities from anywhere in the world.

You can know the story about Motusbank by watching this video:

Different Types of Accounts with Motusbank

There are a variety of options available to a customer to open an account with the bank. The different types of accounts offered are mortgages, no fee chequing account, savings account, GICs and personal loans.

Motusbank Savings Account

The bank offers a high interest savings account that offers up to 1% interest.

TFSA savings (Tax Free Savings Account) account offers interest up to 1.10% and RRSP (Registered Retirement Savings Plan) savings account which provides interest up to 1%.

Features of Motusbank Savings Account

- The savings account with Motusbank has the following features: –

- They provide highly competitive interest rates.

- You can have unlimited debit purchases and withdrawals.

- You can deposit up insurance up to $1,00,000 by CDIC.

- There are zero monthly fees charged.

- You are not required to have a minimum balance in your account.

- There are more than 3700 ATMs across Canada which you can have free access to.

- The automated savings feature rounds up your purchases and allows you to save more.

Motusbank Chequing Account

A chequing account is an account with the bank which allows you to deposit your money and withdraw how much you want.

They are also called demand accounts and are dependent on the transaction that you perform.

Some banks charge a monthly fee for you to carry out the transaction but Motusbank offers a checking account without you required to pay any monthly fees.

Features of Motusbank Chequing Account

The following are the features of no fee checking account: –

- You can have free and unlimited Interac transfers

- They accept mobile cheque deposits

- There is no minimum balance required for your account

- You can have unlimited debit purchases, withdrawals, and bill payments

- Your first 25 check orders are free

- You can have free access to more than 3700 ATMS all across Canada

- You can earn an interest up 2.15% on your account balance.

Motusbank GICs

A Guaranteed Investment Certificate Account or a GIC account is similar to a savings account in which you deposit your money and earn interest on that money.

Unlike savings accounts in which you can keep money for an unlimited period of time, GIC accounts have a time period for which you are allowed to keep your money.

Motusbank has GICs which you can use inside RRSP TFSA or RRIF. You can even use GICs if you don’t have any registered account.

Features of Motusbank GICs

The interest rates of GICs keep on changing and as of January 2022 the interest rates are as follows:

- 1.5% for one-year GIC

- 1.65% for 2 years GIC

- 1.60% for 3 years GIC

- 1.65% for 4 years GIC and

- 1.65% for 5 years GIC

These interest rates are applicable to all the forms that is TFSA RRSP and RRIF

Motusbank also has different interest rates for long term GICs which are non-redeemable and are eligible for non-registered accounts.

The interest rates are 1.40% for one year, 1.20% for 2 year 1.30% for 3 year 1.40% for 4 year and 1.50% for 5 years.

To know more about Motusbank GIC interest rates, you can visit this official link.

Motusbank Investing Account

Motusbank has partnered with Qtrade Investor. They are one of Canada’s top rated online brokers.

They offer a wide range of investments ETFs, stocks, mutual funds, bonds etc. The investing feature is available both for registered and non-registered users.

In partnership with VirtualWealth, they offer investing advice. It is a fully automated service that helps you manage your financial goals, risk tolerance and timeline.

Motusbank Mortgages

The bank provides a mortgage period from 1 to 5 years. They also provide different kinds of payment methods you can choose as per your requirement. The interest rates for 1 to 5 year fixed mode cage plans are 1.89%.

Motusbank Mortgages Features

Some of the features which the bank provides in their mortgage plans are: –

- You can pay 20% of your original amount without paying a penalty each year. 20% will be calculated on your principal amount.

- They also have 20% regular payment in which you can pay 20% of a principal amount monthly without paying up penalty

- You can also skip up to one month of payment in a year and you won’t be charged any fees for that

- They also have flexible payment schedule like weekly monthly biweekly or semi-monthly you can save an interest if you make payments weekly or biweekly.

- They also provide various calculators for you to know how much you need to pay.

The calculators are Mortgage Affordability Calculator, Mortgage Payment Calculator, Mortgage Payment Repayment Calculator etc.

Motusbank Lending

Motusbank lending provides the Home Equity Line of Credit (HELOC).

You can borrow loans starting at 2.75%. You can set up the payment method (regular or lumpsum), and the interest will be deducted from your account automatically.

With Motusbank app, you can also transfer funds from HELOC to your chequing or savings account.

Motusbank Features

- You only need to pay interest on the principal amount that you borrow

- You get flexible payment options

- You can borrow up to 65% of the value of your house.

- Your line of credit will always be available, and you don’t need to reapply.

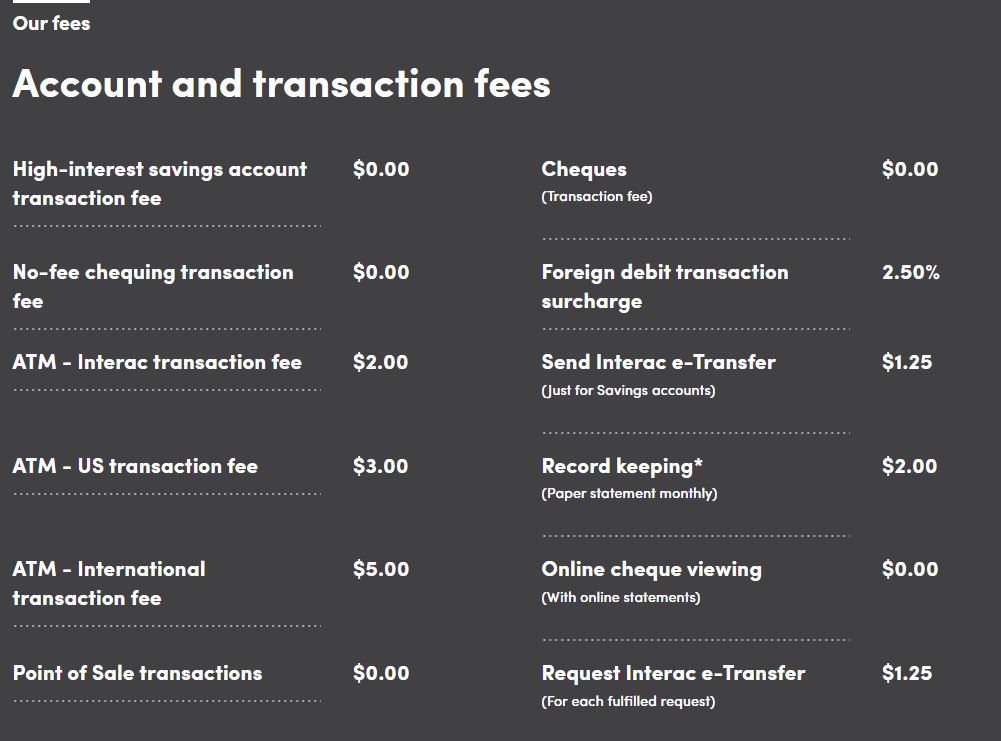

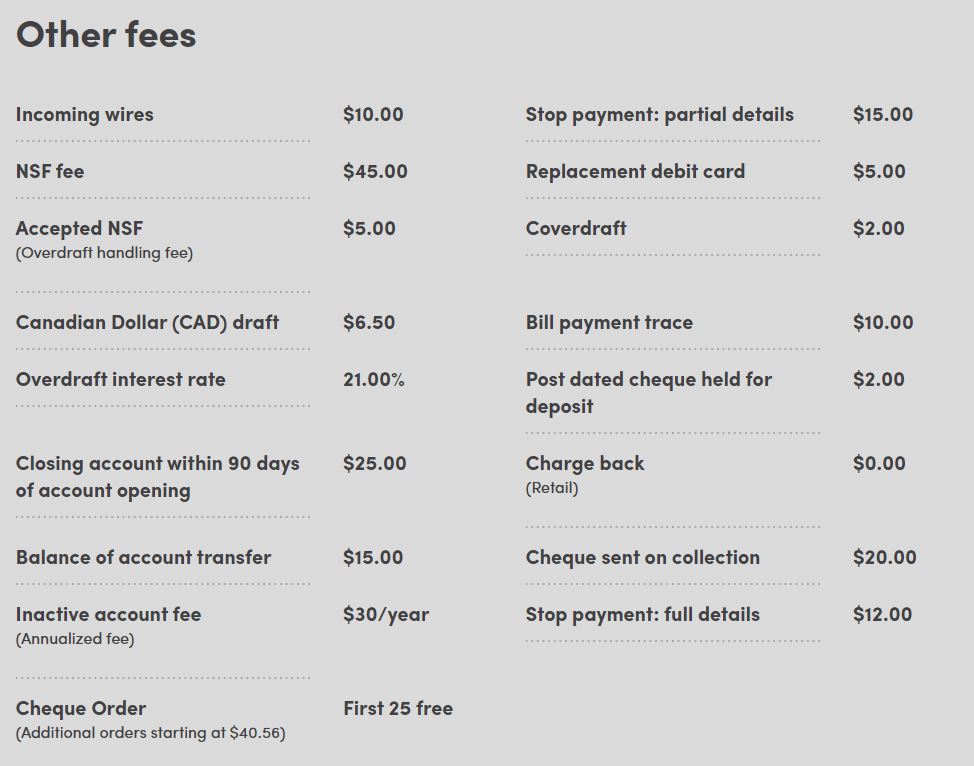

Motusbank Fees

The fees charged by the bank depends on the type of account you have and the amount of money which you are transacting.

If you have a high interest saving account, the transaction fees are zero. For cheques and for non-fee checking transactions also the fees are zero. The fee for ATM Interac transaction is $2 and foreign debit transactions, the surcharge is 2.50%.

If you are sending a transfer from a savings account will be charged $1.25. For US transactions using an ATM, the fee is $3 and any other international transaction using an ATM is $5. You can view your check online and the point-of-sale transaction for free.

The fees for request Interac transfer per fulfilled request is $1.25.

To know more about Motusbank fees, you can check this official link.

Motusbank Pros

- Since a lower fee is charged you can save money.

- You get high interest savings and is more than what other banks have to offer

- You can earn interest on checking accounts. The bank pays you 0.15% interest.

- They also have a mobile app which allows you to conduct transactions on the go. The app is available both on Android and iOS.

Motusbank Cons

Since there is no physical branch of the bank available, if you face an issue with the online transactions you may have to contact them on the number or through mail which may not always be available to solve your query.

Motusbank Reviews

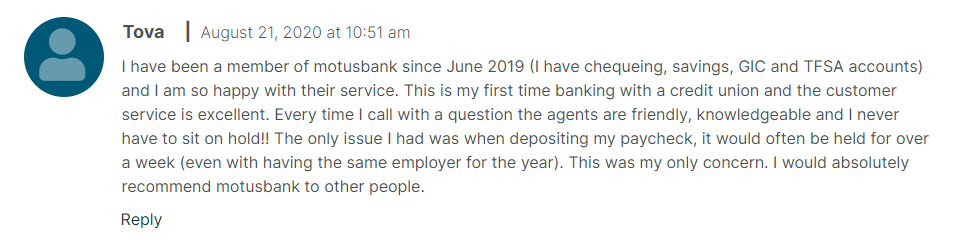

In this section, we are going to look at some Motusbank reviews available on the web.

Motusbank has mixed reviews on Google Playstore and other application rating websites, with some people very happy with the “digital” services, while others not so happy.

If you are looking for a digital bank, you can try Motusbank but do read all thier terms, conditions and fees before opening an account.

Motusbank Positive Review

Motusbank Negative Review

You can read more Motusbank reviews here

Motusbank Customer Contact Information

Motusbank Phone- 1-833-696-6887

Motusbank Email- memberservice@motusbank.ca

Motusbank Social Media Channels

Motusbank is also active on all major social media channels so if you have any concerns or queries, you can get in touch with Motusbank team through these social media channels.

Frequently Asked Questions about Motusbank

Who owns Motusbank?

Motusbank is a subsidary of Meridian, the largest credit union in Ontario.

Is Motusbank safe?

Yes Motusbank is 100% safe.

How do I transfer money to Motusbank?

You need to select on Transfer option from your bank and select, Link Other Bank account and proceed with instructions.

Does Motus Bank have a debit card?

Yes Motus bank will send you debit card when you open a savings or chequing account.

Is Motusbank a real bank?

Yes, Motusbank is a real, digital bank.

What are the disadvantages of credit unions?

Limited locations and memebership charges are the common disadvantages of credit unions.

How many customers does Motusbank have?

350,000 members.

How do I set up auto deposit for Motusbank?

Login to Motusbank, select Direct Deposit Form.” under “Settings” choose “Add a Direct Depositor.

Is Motusbank available in Quebec?

No Motusbank is not available in Quebec.

Recommended Reads

6 Free & Best Chequing Account Canada Banks Can Offer You in 2021

10 Easy Ways to Make Money Online in Canada

Instant Approval Credit Cards for Bad Credit in Canada

How to Write a Cheque in Canada: A Step-by-Step Guide

Lending Loop Review: Pros, Cons & Fees of Peer-to-Peer Lending in Canada in 2021

10 Easy Ways to Make Money Online in Canada

Recommended Reads

Side Hustles to Help You Make Money Online

How to Earn Money from YouTube [Step By Step Guide]

10 Easy Ways to Earn Money Online

How to Earn Money from Facebook [Step By Step Guide]

Best Work from Home Jobs to Earn Money Online

12 Best Paying Entry Level Work from Home Jobs That Require No Special Qualifications

How to Start Blogging and Make Money

Motusbank Review

Motusbank Summary

Motusbank is a virtual bank in Canada that operates online. It offers its customers checking accounts with zero fee charged on interest. It also offers highly competitive personal loans and high interest saving accounts and mortgage rates. Motusbank has mostly mixed reviews online, so if you are looking for a digital bank, you can consider Motusbank but please do read all terms and conditions related to your Motusbank account.

Overall

4.5-

Motusbank Review

Pros

Since a lower fee is charged you can save money.

You get high interest savings and is more than what other banks have to offer

You can earn interest on checking accounts. The bank pays you 0.15% interest.

They also have a mobile app which allows you to conduct transactions on the go. The app is available both on Android and iOS.

Cons

Since there is no physical branch of the bank available, if you face an issue with the online transactions you may have to contact them on the number or through mail which may not always be available to solve your query.