Last Updated on 1 month by Anoob P T

In this post we look at SimpleTax Review including SimpleTax Features, Fees, Pros, Cons & How to File Tax Using SimpleTax.

SimpleTax is a platform to file taxes and this can be useful if you are an online entreprenuer who makes a full time income from various sources online.

SimpleTax Review: Features, Fees, Pros, Cons & How to File Tax Using SimpleTax

Table of Contents

What is WealthSimple Tax (SimpleTax) Canada?

SimpleTax was established in 2012 with the mission to offer Canadians a simple and affordable way to file their income tax returns online.

The service has dominated the market since it is technically free to use, but instead has an uncommon donation-based fee system that asks customers to pay what they like or nothing at all, even for those filing multiple returns.

This flexible pricing, paired with a genuinely easy-to-navigate user interface, makes Wealthsimple Tax one of the premier affordable income tax filing services in Canada.

The popular Robo-advisor Wealthsimple took over SimpleTax in 2019 and renamed it Wealthsimple Tax.

Official website of WealthSimple Tax (SimpleTax): https://simpletax.ca/

How WealthSimple Tax (SimpleTax) Works

WealthSimple Tax (SimpleTax) uses your money for an investment in a diverse portfolio at the global level of inexpensive index funds, and the platform’s elite technology aids you in earning the highest possible return while ensuring that the tax bill is optimal.

They also provide services like instant rebalancing, dividend reinvestment, and harvesting tax losses.

WealthSimple Tax (SimpleTax) Available Countries & Locations

The WealthSimple Tax (SimpleTax) platform is available in Canada.

SimpleTax also functions in Quebec.

WealthSimple Tax (SimpleTax) Features

Here are a few features because of which WealthSimple Tax (SimpleTax) is a popular choice:

- If you pay a fine or greater interest to CRA by any mistake on behalf of the software, they will return it back to you. This is a 100% guarantee.

- Wealthsimple Tax promises that users will get the maximum refund possible for their circumstances when they file the income return using this platform. If a different platform gives back users a bigger refund, the platform will give back any additional payments you made for that year.

- Wealthsimple Tax is authenticated by the CRA to submit returns using the NETFILE tool.

- The step wise structure of the form is easy to comprehend. In case there are any queries, the customer service support team is just an email away.

- The Auto-fill return choice correctly fills part of your return with details taken from the CRA directly. This step makes the process more convenient.

- You can access the Wealthsimple Tax directly from the browser and from your mobile phone using the app.

- People filing a tax return will see how Wealthsimple Tax caters to both basic and complicated tax situations. It can handle not just personal or individual income but also rental, business, and investment income.

- You can use the tax calculator to get an estimate of how much you owe in taxes, or use the RRSP calculator to understand how your contributions affect your taxes.

WealthSimple Tax (SimpleTax) Fees

While other online tax platforms have different pricing plans that may confuse people, Wealthsimple Tax’s pricing scheme is straightforward, it’s entirely free.

Although, they do encourage users to donate to use the software.

Their default donation is priced at $19.

How to Join WealthSimple Tax (SimpleTax)

To join and start your journey with WealthSimple Tax (SimpleTax), you can visit the official website and click the Start your tax return button.

Thereafter, you can create an account and get started by filling out the required/asked for details, including your name, date of birth, address, marital status, province of residence, and whether you are registered with the CRA.

In case you are a returning Wealthsimple user you can file your taxes from your Wealthsimple dashboard.

When you log into your Wealthsimple profile, click on the “Taxes” option in the top menu bar, and you’ll be taken to Wealthsimple Tax through the Wealthsimple portal.

How to File Tax with WealthSimple Tax (SimpleTax)

Users can only file their income tax returns once they’ve created an account with WealthSimple Tax (SimpleTax).

Once the basic questions have been answered and the linking of the CRA account is done, Wealthsimple Tax will import any documents available from the CRA to auto-fill the return invoice and hence speed up the process.

Wealthsimple Tax will also ask you a few questions about your tax situation, income, and investments.

This allows the platform to determine which deductions you’ll qualify for, and to formulate the rest of your return.

You can monitor your progress and your refund using the navigation menu. After you’ve entered any additional investment information, T4s, and claimed all of your deductions, you’ll have a chance to review your tax summary.

If there are any errors, you can address those. Once you’re done reviewing your return, you can submit it using the CRA NETFILE functionality.

If you have a direct deposit with the CRA, you can receive your income tax refund within two weeks of filing your return.

Pros of WealthSimple Tax (SimpleTax)

- The Wealthsimple Tax platform is legitimate as per the CRA and makes use of the encrypted NETFILE feature to transmit your data safely and securely.

- The platform has a beginner-friendly interface hence even if you are completely new, there won’t be any issues.

- The platform is completely free, just donations are encouraged but ultimately the decision lies with you.

- It is apt and works for all tax situations in Canada.

Cons of WealthSimple Tax (SimpleTax) – Bullet Points

- The platform does not have enough sophistication for all business owners, income property owners, people who are not permanent residents of Canada, or those who have recently emigrated from Canada.

- Wealthsimple Tax does not lend aid to the AgriStability and AgriInvest programs and hence is not apt for farmers who use these tools.

- Wealthsimple Tax does not offer services like tax audit and the service for an individualist tax review by an experienced professional which may be an essential service required for some people.

WealthSimple Tax (SimpleTax) Reviews

In this section, we also try to show you one positive and one negative review of WealthSimple Tax (SimpleTax) so that you get a general idea about the platform.

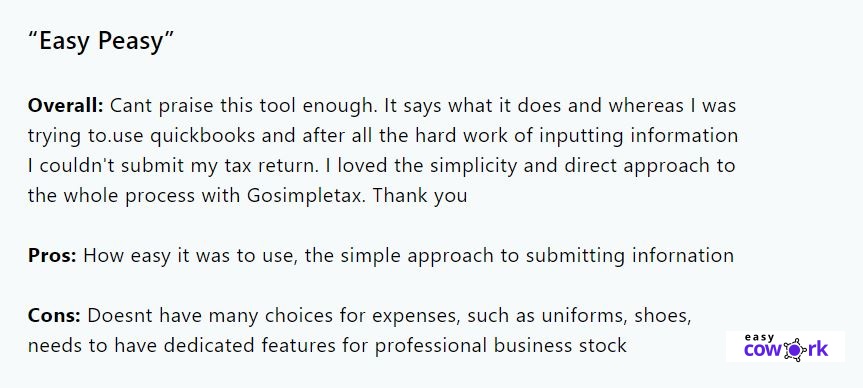

WealthSimple Tax (SimpleTax) Positive Review

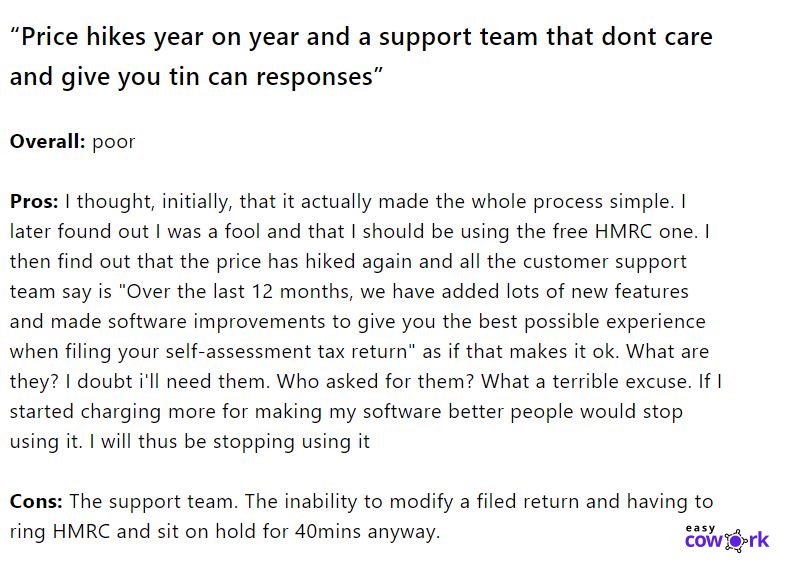

WealthSimple Tax (SimpleTax) Negative Review

Is WealthSimple Tax (SimpleTax) Legit?

For both new and experienced tax filers, Wealthsimple Tax offers an easily affordable and convenient way to file your taxes directly with the CRA.

While the support options or tools are to an extent finite, Wealthsimple Tax is still a good option if your tax situation is straightforward.

And in case your tax situation requires special attention and personalized advice, you can always switch to a more qualified paid platform.

WealthSimple Tax (SimpleTax) Customer Contact Information

You can call the WealthSimple Tax (SimpleTax) Customer service support team anytime between 9 am – 5:30 pm (EST), Monday to Friday.

They are accessible via email at any time even on off days.

WealthSimple Tax (SimpleTax) Email: help@simpletax.ca

WealthSimple Tax (SimpleTax) Ticket Support: https://help.wealthsimple.com/hc/en-ca/requests/new?ticket_form_id=360004836634

WealthSimple Tax (SimpleTax) Phone Number: 1-855-255-9038

WealthSimple Tax (SimpleTax) Contact Link: https://www.wealthsimple.com/en-ca/contact/

WealthSimple Tax (SimpleTax) Social Media Accounts

WealthSimple Tax (SimpleTax) is also active on all major social media accounts, you can get in touch with the company through these accounts

WealthSimple Tax (SimpleTax) Instagram

WealthSimple Tax (SimpleTax) Facebook

WealthSimple Tax (SimpleTax) Twitter

WealthSimple Tax (SimpleTax) Alternatives

There are several platforms and websites that provide services of income tax filing and are CRA-approved and even offer free versions.

Though it is imperative to note that the features available on the free versions may or may not always be what you need.

Some of the most common alternatives to WealthSimple Tax (SimpleTax) are TurboTax Free, StudioTax, CloudTax, and also GenuTax.

Frequently Asked Questions about WealthSimple Tax (SimpleTax)

Is SimpleTax safe?

Yes, WealthSimple Tax (SimpleTax) is a safe and legit company that can be used to file your taxes.

Is SimpleTax really free?

Yes, it is free.

Are Wealthsimple fees tax deductible?

Only the management fees charged on Non-Registered investment accounts such as Personal, Joint, and Corporate accounts can be tax deductible.

Which free tax software is best Canada?

WealthSimple or SimpleTax and TurboTax are some of the best tax software in Canada.

Recommended Reads

Side Hustles to Help You Make Money Online

6 Free & Best Chequing Account Canada Banks Can Offer You in 2022

10 Easy Ways to Make Money Online in Canada

Instant Approval Credit Cards for Bad Credit in Canada

How to Write a Cheque in Canada: A Step-by-Step Guide

Lending Loop Review: Pros, Cons & Fees of Peer-to-Peer Lending in Canada in 2022

10 Easy Ways to Make Money Online in Canada

How to Earn Money from YouTube [Step By Step Guide]

10 Easy Ways to Earn Money Online

How to Earn Money from Facebook [Step By Step Guide]

Best Work from Home Jobs to Earn Money Online

12 Best Paying Entry Level Work from Home Jobs That Require No Special Qualifications

How to Start Blogging and Make Money

SimpleTax

WealthSimple Tax (SimpleTax) Summary

WealthSimple Tax (SimpleTax) has overall 4 star rating out of 5 on most review platforms. However, there are some complaints about WealthSimple Tax (SimpleTax) as well. If you are looking for a simple, easy to use Tax filing online platform you can consider WealthSimple Tax (SimpleTax) but there are many users who have complained of slow customer support response and change in fees.

Overall

4-

SimpleTax

Pros

Easy to get started

Easy interface

Simple to Use

Cons

Slow customer support response times

Can increase fees